In real life, hipchickindc is licensed as a real estate broker in the District of Columbia, and as a real estate salesperson in Maryland. Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system. Information is deemed reliable but not guaranteed.

Featured Properties: 1344 Taylor St NW

Original List Price: $675,000.

List Price at Contract: $499,000.

List Date: 10/19/2009

Days on Market: 134

Settled Sales Price: $517,500.

Settlement Date: 03/25/2010

Seller Subsidy: $12,500.

Bank Owned?: No, but is listed as a short sale

Type Of Financing: FHA

Original GDoN Post is: here.

Listing is: here.

I’ve had a few requests to do a Good Deal or Not Revisited (GDoN-R) on 3600 13th St NW, which is that huge detached single family house at 13th and Otis. Someone noticed a “SOLD” sign on it this week. I touched base with the listing agent, Denise Champion, and she says they should be headed to settlement this week. If it happens, I promise I’ll do that one next week.

Today’s GDoN-R is one of few short sales that I’ve seen come to fruition in DC. They are all over the suburbs, but make up a very small percentage of our inventory downtown. I’ve posted in the past about short sales, but for anybody who is not familiar with the concept, it means that the owner of the property owes more to their mortgage lender than the current market value of the property. When a prospective purchaser writes an offer, it is technically ratified between the purchaser and the seller, however, there is a contingency for a “third party approval”. Depending on who that third party is, whether there is a second trust on the property, and whether the moon and stars are in correct alignment, these things can take many months to move forward. Often, by the time the bank has approved a short sale, the buyer has chosen to move on to another property. In any case, for all parties involved, it is an exercise in patience (or futility…I had a property under contract as a short sale, only to find out that the foreclosure had already gone through, despite the seller having had ongoing communication with a short sale negotiator. The buyer was heart broken. After months of attempting to contact the trustee and REO execs at the bank, we ended up catching the foreclosure immediately upon being listed and fortunately had a sympathetic listing agent involved. The buyer should go to settlement next week.) Continues after the jump.

In this case, the listing comments mention that the “short sale is almost approved”. This indicates that there probably was an initial contract but that the original buyer didn’t want to wait around. That set the stage for the next buyer, who was able to take advantage of the approval already in progress. Most banks have not been willing to even consider looking at paperwork for a potential short sale before there is a contract in hand. There was recent legislation passed that affects banks who are participating in the Home Affordable Modification Program (HAMP). Those banks are now supposed to respond to listing agents within a specified period of time, before the property even goes on the market. With the amount of backlog being reported, it’ll be interesting to see how readily these changes take place.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

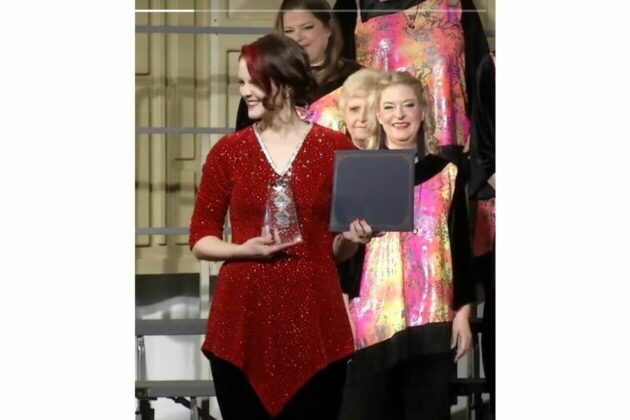

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have