Griffin & Murphy, LLP, is a boutique law firm in Washington, D.C. concentrating its practice in real estate law (including development, finance, leasing, zoning and condominium conversions), as well as estate planning and probate, civil litigation, and business law. The attorneys of Griffin & Murphy, LLP are licensed to practice law in the District of Columbia, Maryland and Virginia. Griffin and Murphy, LLP was founded in 1981.

Please send any legal questions relating to real estate, rentals, buildings, renovations or other legal items to princeofpetworth (at) gmail (dot) com, each week one question will be featured. Ed. Note Griffin & Murphy is a PoP advertiser. You can find previous questions featured here.

Bonus question this week since we missed last week.

Photo by PoPville flickr user Rukasu1

Question:

I am on a condo association board for a property here in DC. At least two units in the property have been subject to foreclosure and are currently owned by banks. These banks are not paying condo fees. My questions are pretty simple: Aren’t these banks obligated to pay condo fees like any other homeowner? And if they are obligated, what options does a condo board have to pursue fees that are past due (for example, is small claims court an option?)

Answer:

Once a bank forecloses on a condo unit and assuming that the bank becomes the owner of the property, the bank is responsible for paying condo fees. However, the bank will not be liable for any condo fees that accrued prior to the foreclosure sale. The D.C. Condominium Act states that in the case of an “involuntary transfer” like a foreclosure sale, the transferee of the condo unit will not be liable for assessments that became due and payable prior to the transferee’s acquisition of the property.

Your condo board has a fiduciary duty to make its best efforts to collect outstanding condo fees. Your condo association has a has a couple of options with regard to collecting the past-due condo fees from the bank.

(1) The association can try to track down the person at the bank responsible for the condo or the property manager hired by the bank to maintain the condo and to pay monthly assessments (most banks do this for their REO properties), but it can be difficult to get in touch with the right person at the bank or at the management company.

(2) The association could also seek payment by enforcing the lien granted to it by the D.C. Condominium Act to secure the payment of monthly assessments. To enforce the lien, the association has a statutory right (unless it is prohibited by your condo documents) to sell the property to satisfy the assessments owed by the bank. The steps for conducting the sale can be found at D.C. Code § 42-1903.13(c)(1).

(3) The association could also file a lawsuit to recover the assessments owed by the bank, and if the association wins, the statute provides that it will be entitled to reimbursement for its costs and attorneys’ fees. The downside to this approach is that it can take several months or over a year for the matter to be resolved in the courts, and even though the association could recover its legal fees from the bank, the association will probably front them initially.

It has been our experience that the easiest and cheapest approach is to wait for the past-due condo fees (and any interest thereon) to be paid when the bank ultimately sells the condo unit, which I’m sure the bank is anxious to do.

This response was prepared by Mark G. Griffin and Patrick D. Blake of Griffin & Murphy, LLP. The material contained in this response has been prepared for informational purposes only and should not be relied upon as legal advice or as a substitute for a consultation with a qualified attorney. Nothing in this response should be considered as either creating an attorney-client relationship between the reader and Griffin & Murphy, LLP or as rendering of legal advice for any specific matter.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

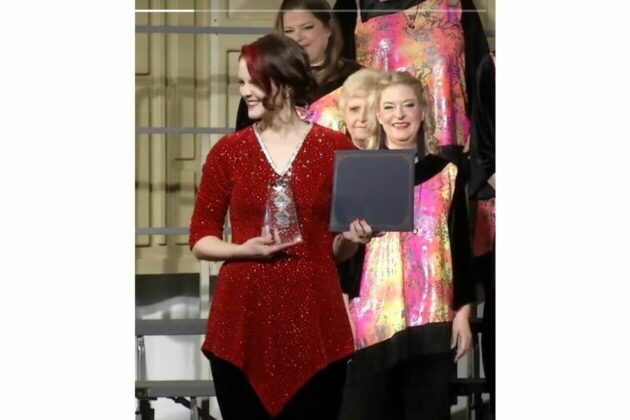

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have