Ed. Note: If you have a PoP-Ed you’d like published, send an email to princeofpetworth(at)gmail with a quick note about the topic you’d like to write about.

Mayor Gray: No Time for Delays. Send New Food Truck Regs to City Council!

By Kristi Whitfield

Co-Owner, Curbside Cupcakes

Curbside Cupcakes is Washington DC’s first mobile cupcake truck. When my husband and I maxed out our credit cards and refinanced our house to open Curbside Cupcakes in 2009, there were only a few food trucks serving the District. Since then our numbers have grown substantially because consumers appreciate and support the influx of new and innovative dining options that many food trucks offer. In light of our popular and growing industry of small business owner/operators, Mayor Vincent Gray has proposed new vending regulations that, while not perfect, are a major upgrade from what’s on the books now. If special interest groups succeed in pressuring the Mayor to send these regulations “back to the drawing board”, then fellow “truckers” like Curbside Cupcakes are in danger of not only losing our businesses but our houses and every nickel and dime we scraped together to make our dreams a reality. And all this over what? Competition. Our detractors say that food trucks are “stealing away” customers from storefronts. This attitude reflects a shocking sense of entitlement. Businesses don’t own customers. Businesses earn customers.

In 2010 the District of Columbia Department of Consumer and Regulatory Affairs (DCRA) collected over 2,500 comments on a previous version of proposed regulations. Food truck opponents were more honest then about their concerns, which boiled down to not wanting to compete with food trucks; given the expenses that storefronts incur for brick and mortar shops they figure why should they have to compete with “outsiders” for customers. This position turned out to be very unpopular, so this time around opponents of the legislation say they have “concerns” about crowded sidewalks, limited parking and increased trash.

In our battle for survival, the food trucks are the little guy. Many food truck owners would have liked to start as storefronts, but most of us don’t have the personal or corporate wealth that would allow us access to hundreds of thousands of dollars to invest in restaurant real estate. Lack of wealth should not limit my husband and me from spreading Cupcake Bliss to all areas of the District.

Continues after the jump.

When Sprinkles decided to open its DC brick and mortar on the same block as Georgetown Cupcake we didn’t hear anyone cry foul. Somehow if a company has enough money to afford the lease they are encouraged to compete. Especially in a recession, we must remove economic barriers, not build them up to exclude small businesses.

It’s ironic that mere months after the Restaurant Association of Metropolitan Washington (RAMW) celebrated brick and mortar restaurants enjoying a gangbuster year, they are decrying the “unfair advantages’ that food trucks enjoy over storefronts. The truth is that there are hundreds of thousands of diners in the District every day, and there are enough customers for everyone. People love fun and innovative food concepts whether it is a sit down meal or curbside.

Any business out there needs to be prepared to compete. Curbside Cupcakes is not the only cupcake truck in town. There are other cupcake trucks and sweet trucks out at the curb with us everyday, and even more coming! We welcome the competition because when there is competition, everyone – most importantly the customers – benefits. Competition kills complacency and the sense of entitlement that leads to taking customers for granted.

Food trucks are a wonderful contribution to Washington, DC. We have taken dining wastelands and turned them into dining destinations. Food trucks have helped re-activate public parks that were woefully under utilized. Don’t forget … we are small businesses that pay rent, pay taxes and hire people — important economic drivers, especially in a recession.

It has taken years for DCRA to draft these new regulations. Every interested party has had a chance to chime in. Now is the time for action. Detractors want to send the city “back to the drawing board,” to limit competition and restrict how and where food trucks are allowed to operate. We hope the Mayor will not cave to these special interests. Parking, sidewalks, and trash are issues that can be addressed without stalling progress.

More than 3,000 supporters have written DCRA, the Mayor and City Council asking them to pass these regulations. Unfortunately, food trucks lack the political capital to protect ourselves from special interests and we need help. After years of conversations, hearings, and focus groups, “back to the drawing board” is the legislative equivalent of killing our businesses and stifling one of the fastest growing industries in the District. I hope Mayor Gray will take a stand for local, small businesses and for the best interests of customers in Washington, DC by submitting these regulations to City Council without delay.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

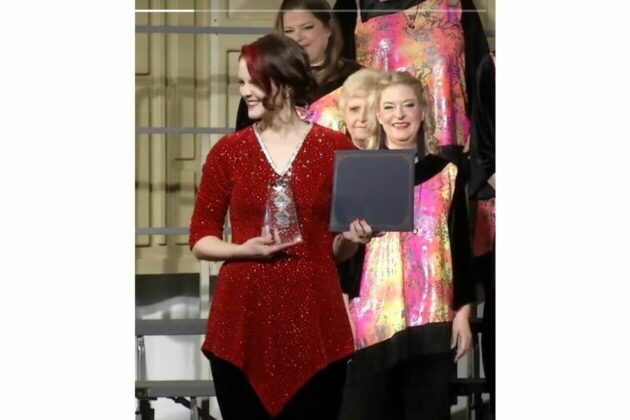

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have