Good Deal or Not Revisited (GDoN-R) is a weekly post that reviews the settled sales data of a recent individual real estate transaction in the District of Columbia. Each post is a snapshot of the real estate market at a particular moment in time. GDoN-R generally posts on Friday in the late morning.

GDoN-R has been written exclusively for PoPville since 2009 by Suzanne Des Marais. Suzanne is a practicing Realtor with the Bediz Group, LLC at Keller Williams Capital Properties . Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system and/or Smartcharts by Showingtime). Information is deemed reliable but not guaranteed.

Featured Property: 1411 D St NE

Legal Subdivision: Old City #1

Advertised Subdivision per Listing: Old City #1

Bedrooms: 3 Baths: 1 Parking: Street Ownership: Fee Simple

Original List Price: $559,500. List Price at Contract: $510,000.

List Date: 11/10/2016 Days on Market: 81

Settled Sales Price: $462,000.

Seller Subsidy: $0.

Settlement Date: 3/1/2017

Transaction type: Standard

Original GDoN post can be seen: here.

The original listing can be seen here: here.

With high demand in the DC real estate market from both investors and owner occupying buyers, sellers can have great expectations. This property was originally priced very optimistically at $559,500., which is higher than what some nearby updated homes have been selling for. You can see recent sales activity in the immediate area here.

It’s useful to note that, while it may seem to sellers and prospective buyers that everything in DC sells above list price, the recent average list to sales price ratio in this area is slightly more than 5% below list price. That said, the listings in this sample were exposed to the market at the end of the election cycle, and through the cold months and holidays.

With the early Spring weather, we’re seeing an early Spring market, which means more listings launched, and a renewed sense of purpose among buyers who are hearing continuing reports of expected increases to mortgage interest rates.

The listing agent for this property was Norris Dodson III with Long and Foster Real Estate, Inc. Joseph Bernstein, also with Long and Foster Real Estate, Inc. assisted the Buyer.

Recent Stories

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Spring into a new dating experience with The Feels. The format fuses meditation + somatic elements like eye gazes + prompts + compliments. It’s designed to leave you feeling seen + heard. Developed in partnership with Columbia university, ongoing research shows its 2x more effective than a typical singles event + 70% of all attendees report walking out with the contact info for someone they’re excited about.

Ticket price includes a 90-min facilitated experience, unlimited wine, zero proof cocktails, light bites + access to a digital community of folks in DC who are also mindfully dating. The event takes place on Thursday, 5/16 at Yours Truly Hotel at 6:30 PM.

This is for the brave ones. You in?

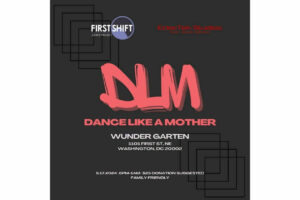

Dance Like a Mother, a Benefit for First Shift Justice…

Join First Shift Justice Project at “Dance Like a Mother,” a fun house music party benefiting DC-area low-wage working parents & caregivers fighting workplace discrimination. First Shift helps working parents assert their workplace rights to prevent job loss. The money

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!