Suzanne Des Marais is an associate broker with Bediz Group, LLC at Keller Williams Capital Properties . Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system and/or Real Estate Business Intelligence (RBI). Information is deemed reliable but not guaranteed.

Featured Property: 1239 Vermont Ave NW #907

Legal Subdivision: Old City #2

Advertised Subdivision per Listing: Logan Circle

Bedrooms: 1 (Junior One Bedroom) Baths: 1 Parking: Garage parking available for sale Ownership: condo

Square Footage per listing: 465

Original List Price: $265,000.

List Price at Contract: $265,000.

List Date: 05/21/2016

Days on Market: 75

Settled Sales Price: $290,000.

Seller Subsidy: $3000.

Settlement Date: 09/15/2016

Settled Net Price per Square Foot: $617.

Transaction type: Standard

Original GDoN post can be seen: here.

The listings can be seen here: here.

Crescent Tower, located near Logan Circle at Vermont Ave NW and N St NW, was built in 1964. The ten story pet-friendly building has a total of 133 units. Amenities for the building include a weekday staffed front desk, a roof deck, pool, exercise room, and extra storage. Deeded garage parking is included with some units (and possibly available for purchase for others). Condo fees additionally include electric, heat, air conditioning, and gas (in addition to the usual things covered by condo fees, such as water and trash pick up).

This particular unit was originally listed for $10,000. less than it sold for in 2005. After over two and a half months on the market, it ultimately sold (net) at 8% higher than the original list price.

2016 has been a great year for Crescent Tower. This is the fourth settled sale in the building and every unit sold so far in the building in 2016 has sold over list price (average ~6% above). For the first time in its long history, two bedroom units are selling for over $500,000. Prior to the recent sales, the highest price point in the building was $450,000. Unit 902, a renovated 2 bedroom, 2 bath sold for $544,999. in April.

The listing agent for this sale was Elizabeth Blakeslee with Coldwell Banker Residential Brokerage. Brian Evans with Redfin Corp represented the Buyer.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

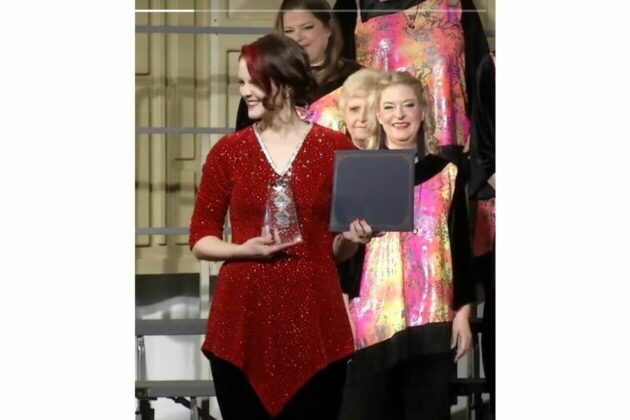

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have