“Dear PoPville,

Last night I visited a grocery store in a nearby neighborhood [I don’t want to put them on blast because I love the store, and because I don’t know if they are to blame] for a few things, paid using my credit card, and went about my evening.

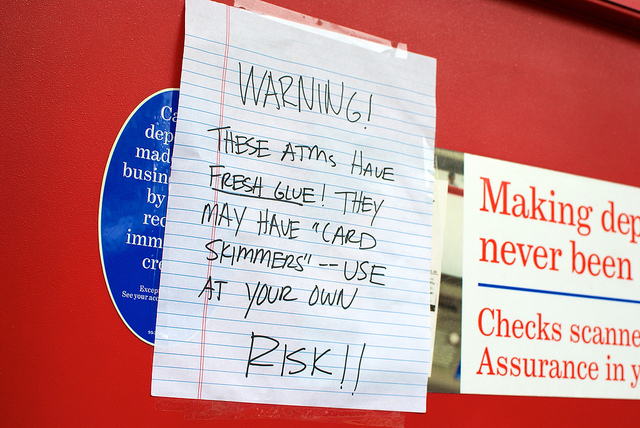

This morning, I happened to log into my cc account and noticed two pending fraudulent charges on my account. My first thought was FU-K! Finally, my card has been hacked from one of the numerous stores/banks/etc that’s been hacked in recent years. Then I looked into the charges and realized they were both from places within 0.5 miles of the grocery store I visited last night. My immediate assumption- someone stole my info at the store. My knowledge of credit card thievery is naive, to say the least, so I have no idea if I should be blaming a fellow grocery-goer for swiping my card info with one of those magic card swipers I’ve heard about, or if the person who checked me out had something fishy going on. But I hadn’t used that card anywhere else in the area for a few days, and the proximity of the fraudulent charges just seemed like the grocery store (or someone who was there) was the likely culprit.

I already cleared everything with my bank, have a new card on the way and wanted to pose a question to PoPville. How far would you go in trying to determine the cause of the fraud? I called the store just to let them know what happened in case they want to look into it- maybe their system was hacked last night. They suggested I call the other businesses to look into the person(s) who made the fraudulent charges- maybe they were caught on tape, and maybe they are an employee of the grocery store I visited.

Part of me doesn’t want to get anyone in trouble. But on the same token- fu-k that! I also don’t want this to happen to others. Would you guys look into it further or just be happy that you settled everything with your bank? Honestly, this is not coming from a place of vindication, and really just because it seems like such a local instance of credit card theft that could be easily prevented from happening again.”

Recent Stories

Photo by Erin Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, I figured I’d shoot my shot. At…

Washington, DC! Let’s choose taters over haters, darlings! It’s DC’s ONLY Drag Brunch Bingo and it’s only at Whitlow’s! Forget your troubles, and let’s get HAPPY! Revel in the ridiculousness with your host, Tara Hoot, as she takes you to Camp Tutti Fruiti Hoot where you can enjoy amazing performances by Shelita Ramen and Mari Con Carne, play bingo, and win campy prizes! Sunday, May 19 at 12:30!

Come for a tasty brunch, bottomless drinks and drag performances that make you laugh and feel better about the world! Why? Because you’re gorgeous and you deserve it! We can’t wait to welcome you!

Tickets are only $10 with additional bottomless drink and food options!

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

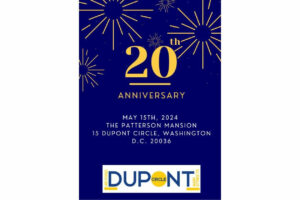

Historic Dupont Circle Main Streets 20th Anniversary!

JOIN US FOR AN EVENING OF IMPACT,COMMUNITY,AND CELEBRATION AS WE RECOGNIZE DUPONT CIRCLES LEGACY BUSINESSES!

5:30 PM COCKTAIL HOUR AND NIBBLES

6:30 PM OPENING REMARKS

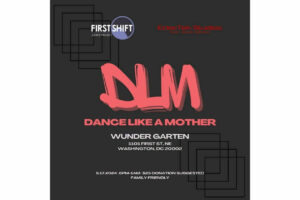

Dance Like a Mother, a Benefit for First Shift Justice…

Join First Shift Justice Project at “Dance Like a Mother,” a fun house music party benefiting DC-area low-wage working parents & caregivers fighting workplace discrimination. First Shift helps working parents assert their workplace rights to prevent job loss. The money