This weekly column is written and sponsored by D.C. real estate agent and Edgewood resident Jessica Evans. Email her questions at [email protected].

For the first time in a long time, buying a home in DC has gotten less expensive! While it may not offset rising prices, every little bit helps. In October 2017 a new benefit to first time homebuyers in DC went into effect, reducing the recordation tax that eligible buyers pay when they purchase their first home in DC.

For the first time in a long time, buying a home in DC has gotten less expensive! While it may not offset rising prices, every little bit helps. In October 2017 a new benefit to first time homebuyers in DC went into effect, reducing the recordation tax that eligible buyers pay when they purchase their first home in DC.

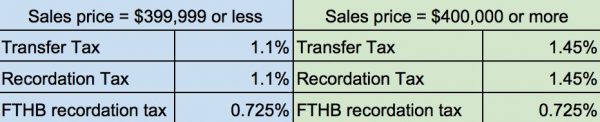

The reduction is between 1-1.3% depending on the sales price, which is not a small amount of money with DC prices being what they are. In my research, there doesn’t seem to be a great deal of information available on this subject, so I wanted to share with you the specifics.

What is recordation tax?

Recordation tax is a one time tax that is paid at settlement on the purchase or sale of a property. This goes by different names and is a different amount in different areas, but in all cases it is essentially a tax on the sale that goes to the state, county or other jurisdiction that is calculated as a percentage of the sales price. This is different from property taxes which are paid annually or semi-annually. Recordation tax is one of the closing costs of purchasing real estate.

In DC, it is customary for a seller to pay the transfer tax and a buyer to pay the recordation tax. Before the first time home buyer (FTHB) recordation tax reduction, the amount paid for the transfer and recordation taxes were equal.

What is the new recordation tax amount?

How to Qualify

This gift doesn’t come without restrictions and is not automatically applied, rather buyers need to apply and qualify for the reduced recordation tax. The application with additional details can be found here. The main requirements include:

- First-Time District Homebuyer

- Either a current DC resident or plan to immediately become a DC resident after purchasing

- Has not owned a residential property in DC

- Income Restrictions

- Calculated by the combined federal adjusted gross income for anyone who will live in the home

- Maximum income limits based on number of people in household

- 1: $139,140, 2: $158,940, 3: 178,740, 4: $198,540

- Eligible Property

- Property purchase price must be $625,000 or less

- Houses, condos and co-ops are all eligible

- Homestead Deduction Application must be included in application

- Applicants must simultaneously apply for and qualify for the Homestead Exemption

- Verifies that the property will be used as a primary residence and owner occupied

How Much Will Buyers Save?

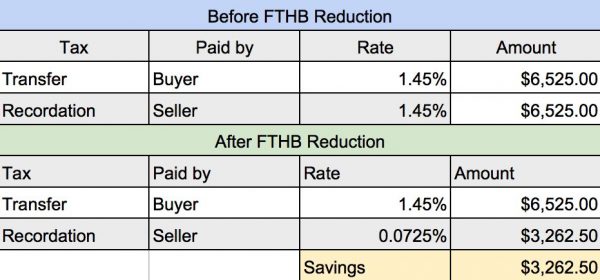

The actual savings will depend on the sales price but let’s look at an example of a property with a sales price of $450,000.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our