“Dear PoPville,

I just closed on a new condo and would like to appeal my DC property tax assessment. It’s a three-unit building (all units are brand new construction with same materials), and they’ve assessed our unit as the most expensive by far ($120K more and $76K more than the other two units) even though ours was the mid-priced one in terms of the list price and the eventual purchase price when comparing the three units to each other.

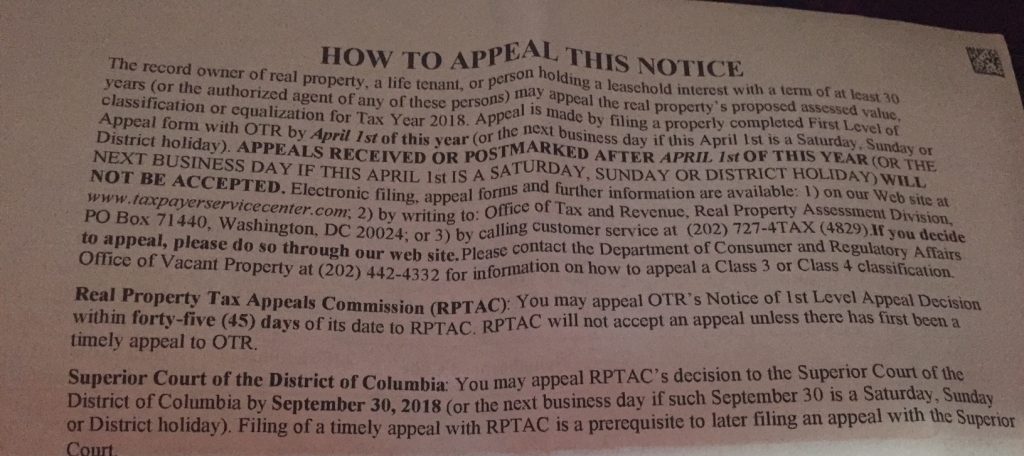

I am definitely going to appeal the assessment and have read many threads on this site and others about how to do it. My remaining question that I hope to have answered here is:

I see that I have to check a box on the form indicating the basis for my appeal. If I appeal on the basis of equalization, comparing my home to the other units in the building as well as comparing it to other properties in the area, and then lose at the first-level of the appeal, can I appeal at the second level on the basis of estimated market value, using the appraisal from my settlement? I’d rather not use the appraisal yet because I feel that we could get a fairer assessment if we succeed on an equalization argument. But IF is the key word. If we don’t succeed on the equalization argument, I want to be able to bring in the appraisal at the second level of review.

Also, I would appreciate any other advice on the appeal, as this is my first time going through the process. Thanks in advance!”

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our