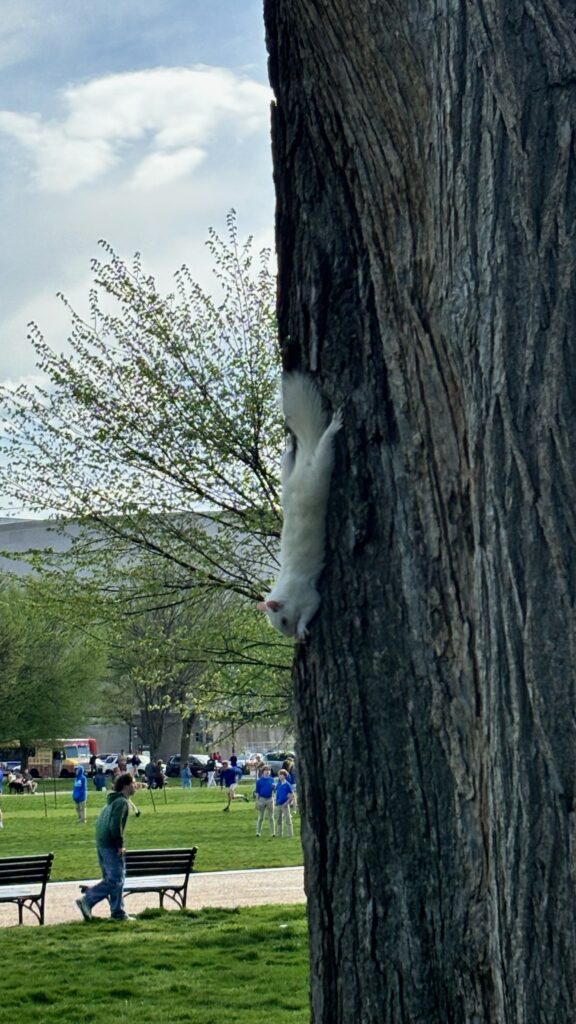

Photo by PoPville flickr user Bogotron

“Dear PoP,

This is probably more of a high school math assignment type of question – but I must have missed that day! I’m the type that got straight A’s in college calculus but can’t compute a math problem needed for practical use! So, HELP — how do I do this??

CALCULATING A HYPOTHETICAL PRESENT-DAY BALANCE HAD A SECURITY DEPOSIT BEEN PLACED IN AN INTEREST-BEARING SAVINGS ACCOUNT WHEN RECEIVED 13 YEARS AGO. . .

DC Housing Regulations state that when a Landlord received a security deposit from a new tenant, that deposit should be placed in an interest bearing account (the total of which + interest ideally would be returned to the tenant in the future upon vacating the unit and assuming no deductions for repairs or damage would be taken).

OK, I admit I didn’t do that 13 years and 1 month ago. In Sept 1997, my tenant gave me $675 for a security deposit. I probably paid bills with it. Had I deposited that money in a dedicated interest-bearing savings account at that time, what would the account balance be today, attempting to account for daily compound interest? (I opened a new “Escrow Savings” account with my bank today to do this the right way with my new tenant. The daily compound interest rate today (Nov. 4, 2010) is 0.05%.)

a. If attempting to get by with estimating: Even assuming that the daily compound interest rate was the same for 157 months (13 years + 1 month) at 0.50% (which it was not)….but for argument’s sake say it was…..how do I calculate what $675 would be worth 157 months later at that rate?

b. If attempting to be accurate, is there an online calculator available that is already programmed with every daily compound interest rate since the beginning of time, enter an amount at a certain date and ask for a projected total at a specified future date? Or for accounting purposes, do they roll up daily compounded interest into a yearly average and plug in the formula 13 times….? _(*^&$^&

For me, this goes into the “too hard” pile, but I need to at least show my due diligence in making this calculation since I didn’t place the security deposit on interest like I should have done. What do other landlords do in this situation….or what would a law firm require should it be an issue? Thanks for your assistance!”

Oh man, my head just exploded. But I have faith in PoPville – can anyone do this calculation? Def. a free PoP t-shirt to whoever is first in getting a proper answer here.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

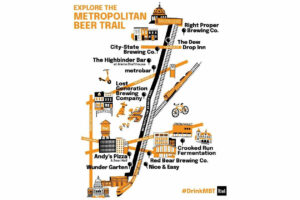

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

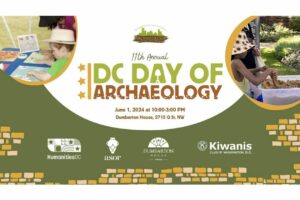

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our