Photo by PoPville flickr user Faucetini

“Dear PoP,

I thought I’d float this by you to see if any of your readers had thoughts on this: I was reviewing my tax assessment for 2011 and comparing it to that of my neighbors across the street who have the exact same floor plan as me. I have 500 more square feet of land than they do, but they operate the 1st and 2nd floor of their house as a boarding house and the basement as a day care center so I would expect taxes to be adjusted for each situation.

Normally, I have always paid about $20.00 per square foot more then them, but according to my 2011 assessment I will pay a whopping $57.00 per square foot more then them. My tax bill went from $515,720.00 to $448,220.00, and theirs went from $400,610.00 to $242,679.00 though neither house has had any improvements or changes.

Does anyone understand how tax assessments are determined in this city? Are there lawyers that can help me get a more fair assessment?”

I think that there is a cap on how much property tax can be raised. So if your neighbor has lived in their home for 30 years and you’ve lived in yours for 3 then the neighbors assessment will be a lot lower. If your neighbor bought her house for $30,000 in 1974 and the tax can only go up no more than 10% a year or something like that then hers will be lower. Does that make sense? This case sounds a bit more confusing so I’m not sure my explanation applies. Anyone else have any guesses/explanations?

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

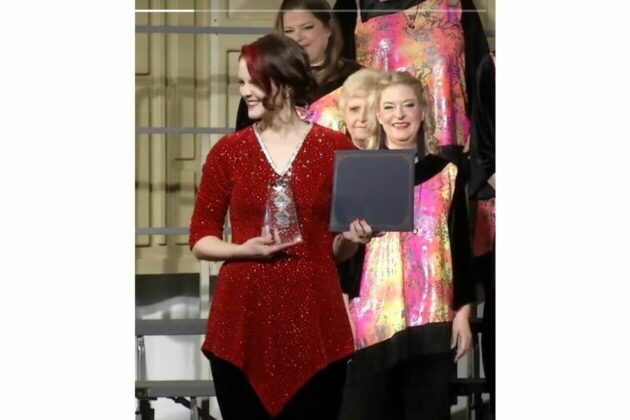

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have