In real life, hipchickindc is licensed as a real estate broker in the District of Columbia, and as a real estate salesperson in Maryland. Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system. Information is deemed reliable but not guaranteed.

Featured Properties: 4824 7th St NW

Original List Price: $165,000.

List Price at Contract: $165,000.

List Date: 10/12/2009

Days on Market: 4

Settled Sales Price: $151,155.

Settlement Date: 12/01/2009

Seller Subsidy: $0.

Bank Owned?: Yes

Type Of Financing: Cash

Original GDoN Post is: here.

Recent Listing is: here.

To better understand this property, please indulge me for a moment while we take the time machine back to the DC real estate market circa 2005/2006. Up to approximately that point in time, property values had escalated for several consecutive years, at an unreal pace. Lenders were bending over themselves to lend money to pretty much anybody who could fog a mirror, including investors. Down payments were non-existent or very low. In cases where down payments were necessary, it was possible for investors to cross-collateralize off of equity in other properties. In this climate, the price to acquire shells (and otherwise crappy properties) went through the roof. (Note that the subject property was purchased in 2006 for $375,000.)

From about 2006, the investor market dropped back considerably. As prices began to fall on fully renovated properties, investors could not make the numbers work. For a while there, I expect that the majority of properties purchased with renovation in mind were bought by end users (owner occupants). Some folks at the time blamed speculators for both driving up the market prices, and for the bust after they all dropped out of sight. Continues after the jump.

Over the past couple of years, many of the properties purchased by inexperienced investors hit the market as foreclosures. As banks tend to not want to be in the asset management business, these properties began to list at significantly lower prices than we had seen for several years. This has brought the investors back into the fold. The game is quite different this time, however, in that most investors playing today rely on their own cash or hard money loans (typically high interest short term loan from private funds or individuals). As we’ve discussed here on PoP before, this has served to frustrate homeowners who would like to benefit from the more affordable prices of foreclosures.

Last week, I also profiled a property that had recently been purchased at foreclosure. The property profiled last week was renovated and re-sold for what was likely a healthy profit. The upside is that we are seeing another rehab boom, so that there are fewer properties that are boarded up and otherwise in bad shape.

I thought it might be interesting to take a look at all of the properties listed in NW DC under $200,000. over the past year.

Since March 2009, there have been 87 fee simple (not condo or co-op ownership) properties in NW DC listed under $200,000. Of those 87 houses, 55 were foreclosures, and only 2 were completed short sales (I’ll have to do a separate posting all about short sales some time). The rest were either regular or, in some cases, estate sales.

The lowest priced property sold in NW last year was 5715 13th St NW. It was listed for $99,900., and sold for $95,000. The listing notes indicate that the “property has mold”.

The average list to sale ratio in this price range was 99.46%. In my experience, even if a property is priced ridiculously low and garners multiple offers, the bank may take a lower cash offer over a higher offer with a loan.

The highest concentration of houses listed below $200,000. over the past year has been in Petworth and the east side of the legal subdivision of Columbia Heights (above the McMillan Reservoir, up to New Hampshire Ave NW, East of Georgia Ave NW).

The lowest price property I have ever personally sold? $5000. I think it was around 2003 or 2004. Fortunately, I was paid a flat fee and not a percentage on that one. (No, it was not in DC).

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

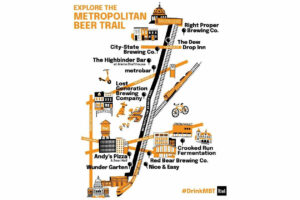

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our