Hipchickindc is a licensed real estate broker. Her latest business venture can be seen here. Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system. Information is deemed reliable but not guaranteed.

Featured Property: 1801 13th St NW

Legal Subdivision: Old City #2

Advertised Subdivision per Listing: Old City #2

Original List Price 1st Listing: $599,000.

List Price at Contract: $599,000.

List Date 1st Listing: 10/27/2011

Days on Market: 11

Settled Sales Price: $950,000.

Settlement Date: 12/16/2011

Seller Subsidy: $0.

Bank Owned?: No Short Sale? No

Type Of Financing: Non-contingent on financing

Original (not offically a) GDoN post is: here.

The listing can be seen: here.

Per the disclaimer at the very top of this post, I am hereby disclosing that the listing agent, Jason Martin, is a colleague affiliated with Keller Williams Capital Properties. Jason was kind enough to share that the property attracted over twenty offers within a short time of being put on the market. Pam Wye, with TTR Sothebys represented the purchaser. I wasn’t able to reach Pam before the holidays for any comment on the buyer’s plans, so hopefully she’ll pop in to comment.

Rather than a typical house or condo sale, this property was marketed as a multi-unit building with two apartments plus a church on the first level. Many commenters on the original post stopped in to say nice things about the long time owner, Pastor Sutton. Thanks to commenter Joel for posting this link to photos of a worship service at the church.

Continues after the jump.

In case anybody hadn’t noticed already, developers are out in full force in DC. After a decade of substantial re-building downtown, raw product for renovation, including multi-unit properties of all sizes, vacant land, and individual houses, is in very short supply. While it certainly does not happen in every case, there were plenty of sales of multi-units buildings that sold above list price in 2011.

As a commenter mentioned, there are limits to how a building can be divided up or added to based upon zoning requirements. Value to an investor really comes down to the number or units that can be sold as a final product, with carrying and construction costs factored in. Although investors can typically offer non-contingent or cash contracts, an end user (either commercial or owner occupant) may be able to offer a better price to the seller since the value is in the use and not as a for-profit situation. Given that the financing of these properties can be tricky, however, sellers sometimes opt for the lesser complications of cash over financing, even if it means a lower sales price.

Recent Stories

Photo by Clif Burns Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Hey – you stopped me while…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

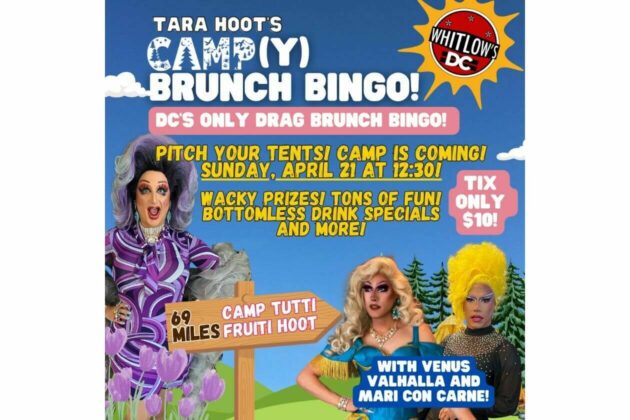

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3: