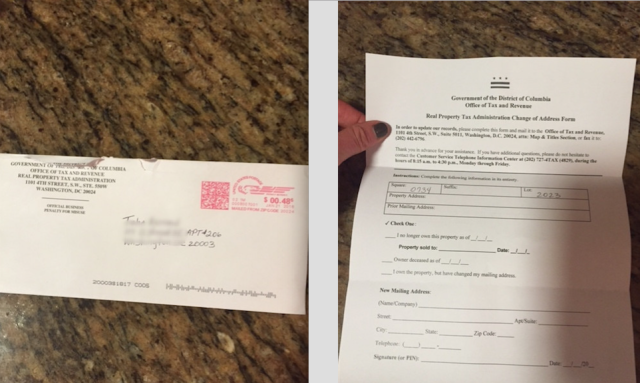

“Dear PoPville,

Received this in the mail yesterday. Always nice to get a handwritten note from this stellar DC office. As far as I’m aware I have not moved, sold my condo, or died. Yikes- hopefully not a premonition. Which box to check?”

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

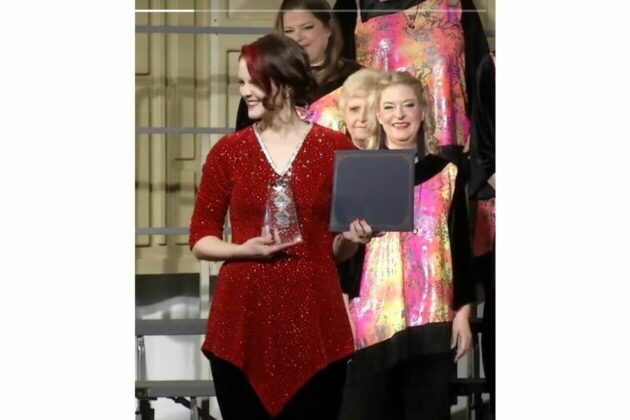

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have