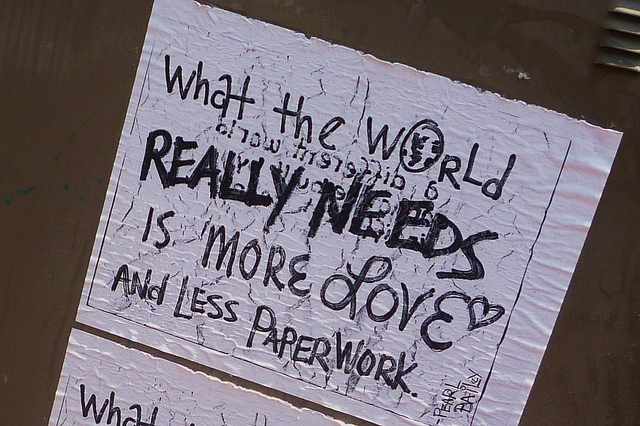

Photo by PoPville flickr user fromcaliw/love

Home buying FINANCIAL INFORMATION SHEET??:

“So, we are new to the area and learning about home buying. We have a Realtor(s) and have found a home we would like to submit a offer on. I should note we are well qualified and obtained pre-approval letters from 2 local & reputable lenders. And without going into details on the forum we have a strong & reasonable offer. (No 100% financing, prior home to sell 1st or anything worrisome/ alarming.

When putting together the offer we were asked by our Realtor(s) to complete a “Financial Information Sheet.” (Never heard of this or done this for the past 4 homes in other states.) The form is asking for details about current & past employment, salary, bank saving/checking accounts, stocks/bonds. life insurance & cash surrender amount, property owned & value, and so forth. It states on the form “This information is presented with the understanding that it may be used as a basis for the acceptance of a contract by the seller. The undersigned hereby authorizes the agent to disclose to the SELLER, SELLERS AGENT, DUAL AGENTS, INTRA-COMPANY AGENTS, COOPERATING AGENTS and Lender ALL OR ANY PORTION OF THE INFORMATION CONTAINED IN THIS FINANCIAL INFORMATION SHEET”

What the heck??? I have not found any law or legal statute stating we need this. And did we not cover all of this with the lender when they ran our credit & looked into all of these things prior to giving us pre-approval for a loan? Why on earth would I provide such much information in so much detail for a person &/or multi-people we do not know?? Seems like this could be a major privacy & identify theft issue. Not to mention used improperly to leverage for a higher sales price. Why does the our agent or buyer or their agent need these details? Especially when we have the pre-approval letter? It is not like the seller has not provided their financial reasons for selling!

We questioned our agent(s) and got this response: “The financial sheet is a must have in our area, the listing agent won’t presents contract without it. People often feel like they are weakening their negotiating position by showing they are well qualified. It just doesn’t work that way, showing your strength never weakens your position, it only strengthens it.

An offer here is never complete without a financial info sheet…”

So, I am wondering if other local folks have run into this? Is a offer truly”incomplete” with out this?

Can’t we submit the offer with only on the pre-approval letter & earnest money? (and at least see what they say?) If the Buyers agent asks for it can either walk or provide limited information?

Is it time to find a different agent? Thanks for any local insight from those with experience on the topic.”

You can see all forum topics and add your own here. If you are having trouble uploading your question to the forum please try clearing your cache. If it still doesn’t work please email me at princeofpetworth(at)gmail

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our