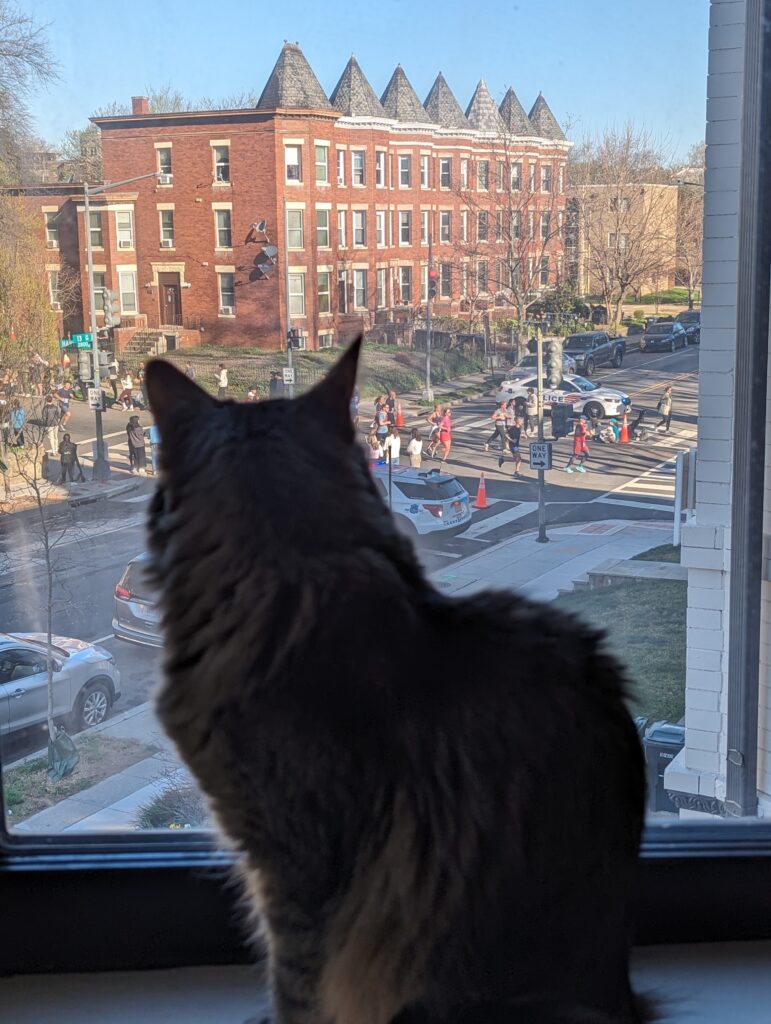

Photo by PoPville flickr user johnmcochran2012

unresponsive neighbor landlord & homestead deduction:

The house next door is a rental (has been for atleast 4 years) and has issues that are impacting our house. We have tried contacting the owner but she is unresponsive to our request to make the repairs. Additionally, I just looked the house up and she is getting the homestead credit. What recourse do we have to get her to make the repairs? Our next step is a certified letter.

Recent Stories

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Spring into a new dating experience with The Feels. The format fuses meditation + somatic elements like eye gazes + prompts + compliments. It’s designed to leave you feeling seen + heard. Developed in partnership with Columbia university, ongoing research shows its 2x more effective than a typical singles event + 70% of all attendees report walking out with the contact info for someone they’re excited about.

Ticket price includes a 90-min facilitated experience, unlimited wine, zero proof cocktails, light bites + access to a digital community of folks in DC who are also mindfully dating. The event takes place on Thursday, 5/16 at Yours Truly Hotel at 6:30 PM.

This is for the brave ones. You in?

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have