Photo by PoPville flickr user hohandy

Griffin & Murphy, LLP, is a boutique law firm in Washington, D.C. concentrating its practice in real estate law (including development, finance, leasing, zoning and condominium conversions), as well as estate planning and probate, civil litigation, and business law. The attorneys of Griffin & Murphy, LLP are licensed to practice law in the District of Columbia, Maryland and Virginia. Griffin and Murphy, LLP was founded in 1981.

Please send any legal questions relating to real estate, rentals, buildings, renovations or other legal items to princeofpetworth (at) gmail (dot) com, each week one question will be featured. You can find previous questions featured here.

I rent a condo in Montgomery County. I have been there about 6 months of a 1-year lease (and have always paid my rent on time). However, the landlord has been having financial problems and now is going into foreclosure. I received papers recently that said the property would be put up for public auction in a few days. What should I, as a tenant, do in this situation to protect myself? As far as eviction goes, I read that there was a recent law that says they have to honor the term of the lease in most cases, so I feel better knowing that. However, I am still concerned about any “scare tactics” or problems that I can expect to encounter along the way. Is it necessary to talk to a lawyer – and what kind of lawyer would best be able to help? I’ve never been in any kind of legal situation like this before and don’t know where to start. And is that going to cost a lot of money? Once the property goes up for auction, who is responsible for repairs on the condo (especially if there was an emergency)? And while this isn’t a huge deal, am I going to have to expect potential buyers coming into my home? I’m not even sure I want to stay in the unit if there are all these legal and communication issues. Is it possible for me to get out of the lease early? Would I be eligible to be reimbursed for moving and other related expenses in that case? And finally, is there anything else that I should know about? Thanks for your help!

Answer:

Duties Owed to the Landlord’s Lender (if any)

As a tenant, you most likely have no obligation to your landlord’s lender unless the lender bids on the condo at the foreclosure sale and the sale is finally ratified by the court. The one exception would be if your landlord’s mortgage contained an assignment of leases and rents provision providing that in the event the landlord defaults on the mortgage, the lender may require that any tenant living in the mortgaged property pay rent directly to the lender. If the mortgage contained such a provision and the lender decided to exercise its rights thereunder, you should have received a notice from the lender informing you of where to send your monthly rent check. Make sure you open all mail that is addressed to the occupant or resident of the rental property, particularly if the envelope indicates the letter is from a law firm or bank. Also, the lender is required by Maryland law to provide you with notice of the impending foreclosure sale and contact information for the person authorized to sell the property. Continues after the jump.

Eviction and the Protecting Tenants at Foreclosure Act

To answer your question about eviction, a new law enacted last year (the Protecting Tenants at Foreclosure Act) provides some relief for tenants like you who are leasing residential property that is foreclosed upon by the landlord’s lender. The new law provides that a purchaser (including the lender) of a foreclosed upon residential property assumes title to the property subject to the obligation to provide an existing tenant with notice to vacate the property at least 90 days before the effective date of such notice. If you have a lease that would expire more than 90 days after the foreclosure sale is ratified by the court, the purchaser of the property must honor the lease until the end of the lease term. However, the purchaser or its successor in interest may terminate the lease earlier if the purchaser intends to occupy the property as a primary residence, but the termination will not be effective until the purchaser has received title to the property and subsequently provided the tenant 90 days notice to vacate the property. Please note that tenants are protected by the new law only if (i) the purchaser/lender became the owner on or after May 20, 2009; (ii) the tenant was a tenant in the foreclosed property at the time the new owner took title; (iii) the tenant is not the child, parent or spouse of the former owner/landlord; and (iv) the tenant’s rent is equal to or is not substantially below fair market rent, or the tenant pays less because she receives rental assistance such as Section 8.

Cash for Keys

Although you will have at least 90 days to vacate the rental property after title has been transferred to the new owner, if you want to move or if the new owner wants you to move, the new owner may, but is not required to, offer to pay your moving expenses and any other costs or amounts you and the new owner agree on in exchange for your agreement to leave the premises earlier than would otherwise be legally required.

Rent and Maintenance

Prior to ratification of the foreclosure sale and the transfer of title to the new owner, the tenant will typically pay rent to the current landlord and will look to the current landlord to make any necessary repairs to the premises. As a practical matter, the lender may want to (and under the mortgage usually has the ability to) correct any problems with the property because it is in the lender’s best interest to preserve the value of its collateral. After the ratification of the sale, the tenant should receive instructions from the purchaser regarding the payment of rent. Lenders usually hire property management companies that specialize in real estate owned (REO) property to maintain the property for them. The new landlord’s maintenance obligations will still be governed by the terms of the lease.

Whether or Not You Should Hire an Attorney

If you feel uncomfortable with all of the legal notices you are receiving, or if you feel like you are not receiving adequate notice regarding the foreclosure process, it might be worthwhile to contact a lawyer that specializes in real estate law for some guidance. A lawyer could also help you in negotiating a “cash for keys” exchange to terminate the tenancy before the federally-mandated time periods. But if you don’t have a lawyer or can’t afford one, I don’t think you will have a problem if you go it alone.

Security Deposit

If you were required to provide your landlord with a security deposit when you signed your lease, the new landlord must recognize the security deposit and refund it to you at the expiration of your tenancy, provided the new landlord has no right to retain all or a portion of the security deposit under the terms of your lease. If the new landlord does not comply with this requirement, the tenant may file a claim for the security deposit in small claims court.

Marketing the Rental Property

While you lawfully inhabit the property, you do not need to allow the new landlord to show the place to prospective buyers unless your lease provides otherwise. A residential lease normally provides the landlord with reasonable access to the property for the purpose of marketing it for sale.

This response was prepared by Mark G. Griffin and Patrick D. Blake of Griffin & Murphy, LLP. The material contained in this response has been prepared for informational purposes only and should not be relied upon as legal advice or as a substitute for a consultation with a qualified attorney. Nothing in this response should be considered as either creating an attorney-client relationship between the reader and Griffin & Murphy, LLP or as rendering of legal advice for any specific matter.

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

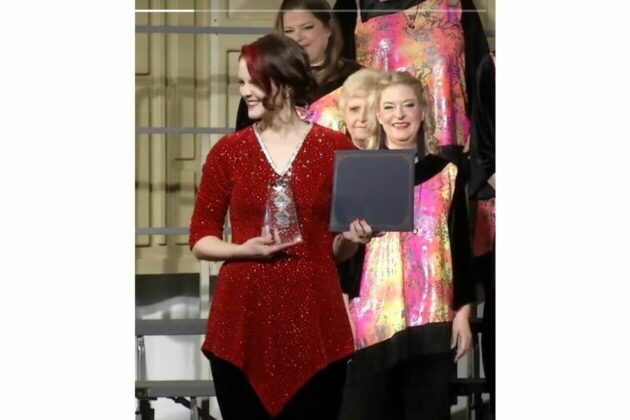

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

St Mary Armenian Church Annual Spring Food Festival

Come hungry and leave happy! Experience culture, community, and cuisine all in one place. See you at the festival!!!!

Comedy Cabaret

Kick up your heels at Bad Medicine’s COMEDY CABARET extravaganza at the DC Improv Comedy Club on Tuesday, May 21st. Revel in the sights and sounds of this entertaining musical revue, with songs, dance and sketch comedy that will have