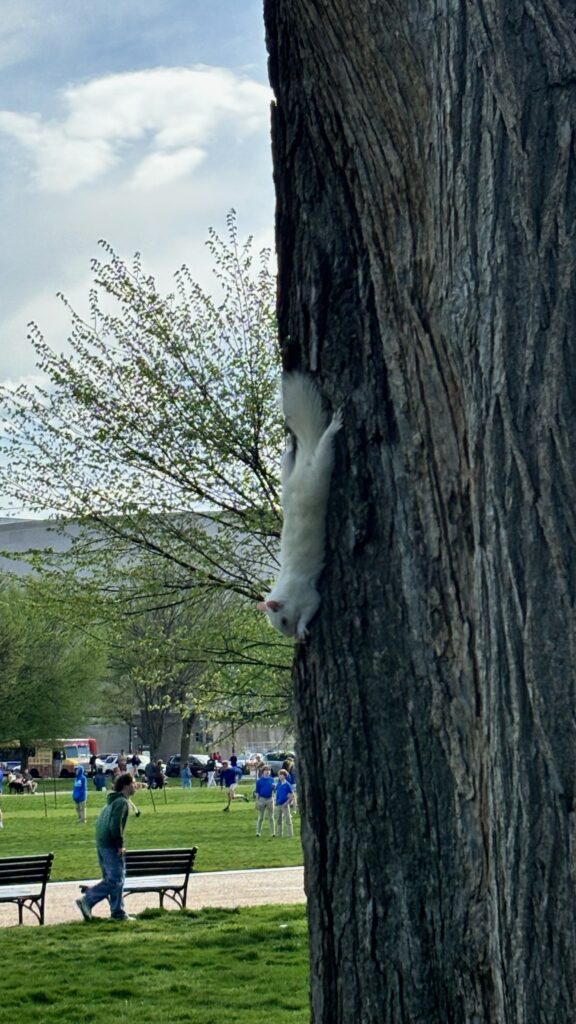

Photo by PoPville flickr user Eric P.

“Dear PoPville,

This isn’t the most exciting news on the planet, but does involve something that could torpedo WMATA’s budget.

ADP, which a lot of private sector companies use to handle employee benefits, sent a notification out yesterday that they will no longer support commuter spending accounts starting in 2016. This means that employees can’t have money taken out of their paychecks pretax and then used to pay for bus and train use. ADP hasn’t been able to work with WMATA on fixing this, so the IRS is essentially shutting it down.

This is not only going to mess up the Metro budget, but is going to wind up costing commuters more money since they can’t use pretax funds.

Here’s the email that ADP sent:

IMPORTANT UPDATE: Commuter Spending Accounts in the Washington, DC Area

Earlier this year, we communicated that restrictions on the use of prepaid debit cards meant that the ADP Commuter Spending Account (CSA) Debit Card could no longer be accepted by the Washington Metropolitan Area Transit Authority (WMATA). Since that time, our dedicated Spending Accounts Compliance Team has thoroughly reviewed all options and confirmed that the ADP CSA Debit Card cannot be configured to purchase WMATA products and maintain compliance with the current, applicable guidance. As a result, WMATA commuters are unable to use the ADP CSA Debit Card. Please be sure to carefully review this announcement as it provides important updates and deadlines for your CSA program.

In our initial communication, we also advised that participants using WMATA could pay out of pocket for their transit products and file claims for expense reimbursement from their pre-tax account. However, IRS Revenue Ruling 2014-32 disallows cash reimbursement of transit expenses incurred after December 31, 2015 if a transit debit card is “readily available”. Since WMATA offers a “readily available” transit debit card, ADP will not be able to process any transit claim submissions for expenses incurred after December 31, 2015. Participants will, however, still have the option of filing claims for reimbursement of parking expenses that were paid out of pocket.

It is our suggestion that you take action to use your full, available commuter transit balance prior to December 31, 2015. You may do this by reducing or eliminating your per-pay-period deduction and/or by submitting any claims for reimbursement of out-of-pocket expenses to ADP with dates of service through December 31, 2015. When submitting claims for reimbursement, please visit the ADP Spending Account website to confirm any claims filing deadlines.

Effective January 1, 2016, ADP will no longer be able to process reimbursement claims for new, out-of-pocket commuter transit expenses. If you are unable to submit claims for reimbursement and have a balance remaining afterDecember 31, 2015, we will work with your employer to determine any available options.

We realize that this represents a challenge for you and ADP is committed to answering your questions. You may contact your ADP Participant Solution Center for assistance.

We look forward to assisting you!”

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our