“Dear PoPville,

My husband and I now live in Athens, OH, where we’ve been battling the DC Office of Tax and Revenue. After my latest round on the phone, I thought I should share with you a potential problem for many who move into the District:

If you move into the District of Columbia between Jan. 1 and before April 15, make sure you save documentation that proves you did NOT live in DC the previous year. If you don’t do that, you could be fighting with the DC Office of Tax and Revenue, which will do its best to extort money from you. They’ll ruin your credit, put liens against your property.

My husband and I moved to DC in January of 2011. The DC Office of Tax and Revenue says we owe taxes for 2010. We’ve been arguing with them for months! The only evidence they have, which they confirmed with me, is that we filed our 2010 federal income taxes from our then-DC home in April 2011. When I pointed out to the agent that means anyone who moves to DC between Jan. 1 and April 15 will have that problem, she replied, “Yes, you’re right.” What the f—?!?!?

When you ask them how to set the record straight, they ask you to send your previous state’s ID — you know, the same one you must turn in when you get a DC license. Again, what the f–?!?! Or some official tax-acceptable paperwork that proves you weren’t in DC the prior year. I’m now digging through our storage files to prove something we shouldn’t have to.

Oh, and if you have a tax accountant, they’ll just ignore her. Won’t even answer her emails.

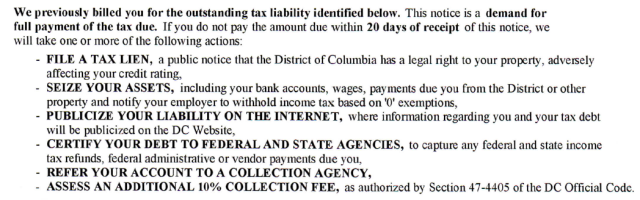

Above is a screenshot of the threatening language from the DC Tax Office.”

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3: