Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

If becoming a homeowner is on your list of New Year’s resolutions for 2023, we’ve got a challenge for you!

What is the 90 Day Homeownership Challenge?

Buying your first home is exciting and empowering but we know that it can also be stressful — especially if you don’t know where to start! At City Chic, we’ve always enjoyed working with first-time home buyers. Our agents do a great job of ensuring our property virgins are educated, informed and involved throughout the process. We know that knowledge is power, so we’ve crafted a 13-week program with weekly lessons that educate you on the ins and outs of buying a home.

This free, 90-day course will help you:

- Get familiar with the home buying process to prepare yourself for a home purchase

- Start taking steps toward homeownership

- Equip yourself with the tools and resources you need to purchase a home when you’re ready

Purchasing a home is a major milestone in your life and most likely the biggest financial purchase you will ever make, so we encourage you to do your homework!

Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

Can you really buy a house with zero down?

Buying your first home can be exciting and scary. The most overwhelming part is figuring out how to finance your purchase and making sense of all your options.

The great news? D.C. has some awesome first time homebuyer programs available. Before we dive into specifics, let’s define a few terms.

- Down Payment: Upfront money to purchase a home.

- Closing Costs: Additional fees due at closing, above and beyond your down-payment, such as fees for an attorney, a title search, title insurance, taxes, lender costs and some upfront housing expenses such as homeowners insurance. Usually 3-4% of sales price.

- Transfer/Recordation Tax: Tax charged at closing by the city/county/state.

- Private Mortgage Insurance (PMI): What you usually pay when you put less than a 20% down payment. PMI insures the mortgage for the lender in the event that the borrower defaults.

Okay, get to it… show me the money! Here’s the lowdown on D.C.’s first time homebuyer programs.

PS — income and price limits change annually, so these numbers are for 2022.

- Overview: 30 year fixed, FHA or conventional loan where they give you 3-3.5% down-payment assistance. The down payment assistance is an interest free loan that is repaid when you sell, move out, or refinance.

- Income Limit: $154,800

- How to Apply: Through a participating lender

Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

This guest post is by Sarah Brazell, Realtor in DC/MD/VA with City Chic Real Estate. Book a call with Sarah!

I’ve had a lot of people ask, “How’s the real estate market?”… and even more friends send me that meme of Will Ferrell in a burning neighborhood yelling: “Does anyone want to buy a house?!”

It’s true the housing market is not the same market it was last year… but that’s not a bad thing!

Super low interest rates for the past decade allowed for people to borrow money for cheap. Those 2% and 3% interest rates flooded the market with tons of buyers who got into an absolute BLOODBATH to buy a home. Those buyers sought to be competitive by driving up the prices of homes. (Is a studio in Foggy Bottom really worth $400,000?) Along with inflating prices, perhaps even more dangerously, those buyers were waiving all contingencies. How comfortable would you have been buying a home without a home inspection or appraisal contingency?

As interest rates have started to rise, the frenzy has settled. Cheap money has dried up and stock portfolios have taken a hit. As a result: housing prices have started to dip, homes are sitting on the market for longer, and bidding wars are a thing of the past. Ladies and Gentlemen it is FINALLY a buyers’ market!

I don’t know about you… but being a buyer now sounds a lot nicer than it used to be!

And the housing market in D.C. remains a great long term investment.

Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

Unless you’ve been hiding under a rock, you’ve probably seen the news that interest rates have gone up significantly since the spring. But what does that mean for buyers in today’s market? It’s hard to separate fact from fiction when it comes to buying a home, and in particular, getting a mortgage. So, what role do interest rates play when it comes to your purchasing power?

Simple answer: interest rates directly correlate to your monthly mortgage payment, so when interest rates rise, so does the monthly payment for your home loan.

How are interest rates determined?

Contrary to popular belief, the Federal Reserve does not directly determine mortgage interest rates. Mortgage lenders base interest rates on the current market, plus a markup that represents the lender’s profit. This is why you’ll see rate fluctuations even though the Federal Reserve hasn’t made any rate changes.

Do all mortgage lenders charge the same rate?

No! Each lender charges different fees and interest rates, which is why we encourage all our clients to speak to 2-3 different lenders.

Should you buy now or wait for rates to go down?

I wish I had a crystal ball so I could tell you what’s going to happen with home prices and interest rates! We are exiting a period of time where we had historically low interest rates. My guess: we probably won’t ever see interest rates in the 2’s again. However, if you want to buy a home, can afford your mortgage at current interest rates, and have a long term game plan, I don’t think there’s a reason to wait. If rates go down, you can always refinance.

It’s not all bad news

We had record-breaking demand for homes the past few years, and it was tough out there for buyers. We’re seeing things start to ease, and a reprieve from insane bidding wars is a welcome change! That isn’t to say bidding wars are gone completely, but it’s definitely feeling less frenzied.

The Bottom Line

No one can time the market perfectly, not even real estate agents. If you’re ready to become a homeowner, now is as good a time as any to take the plunge. Especially if you’re in a stable spot. Don’t let the news about rising rates scare you away!

City Chic Real Estate is a woman owned, independent real estate company, specializing in helping first time buyers and sellers in the DMV. Book a no pressure, intro call with our team at citychicre.

Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

The rental market has been a rollercoaster ride since early 2020.

Many people scooped up great deals on rentals during Covid, however, we’re definitely seeing the tide start to turn. Rental demand and prices, are up. According to Delta Associates, rents in the D.C. metro area are up 15.7% from Q1 2021 to Q1 2022.

With double-digit rent increases becoming more common, many renters are wondering: is now the right time to buy a home?

Here are some questions to get you thinking about whether homeownership is right for you.

Why is owning a home important to you?

Knowing your motivation for being a homeowner is important! Is it a goal you’ve always had? Do you long for a place you can make your own? Is it a financial investment in your future? Are you hoping for some stability in your long-term housing expenses? Whatever the reason, you should have a good one!

How long will you own this home?

Notice I didn’t say “live”, I said “own”. This can be a tricky one, especially if you aren’t sure how long you’ll be staying in the D.C. area. It can take years for prices to appreciate enough to breakeven on a sale, so you should have a plan B if you find yourself in that situation. For most people, they rent their home out until they can sell for a profit.

Can you afford it?

You’re not just paying the monthly mortgage payment, you’ll have condo/HOA dues, property taxes, insurance and utilities. Homes also need maintenance and repairs. We recommend putting together your annual budget to see if homeownership fits into the broader financial picture for your life.

Do you want the responsibility?

If something goes wrong or needs repairs, it’s on you. No more calls to your property manager or landlord. Some people just don’t want the responsibility of maintaining a home, and that’s totally fine!

Does your wish list line up with your financial reality?

Write out all your wants and needs, along with preferences on home type and locations. This can also be a good time to chat with a mortgage lender to see what options are available! (PS: happy to send you my recommendations)

Ultimately, there’s no shame in the renting game! But if homeownership is in your future, answering these 5 questions is a great place to start.

Want extra credit? Download our free, First Time Buyer Workbook, which will give you an even deeper dive into buying your first place.

City Chic Real Estate is a woman owned, independent real estate company, specializing in helping first time buyers and sellers in the DMV. Book a no pressure, intro call with our team at citychicre.

Get Smart With City Chic is a bi-weekly column giving you the real talk rundown on what’s happening with the D.C. real estate market. Sponsored and written by Lindsay Dreyer, the broker/owner of City Chic Real Estate.

Welcome to our first installment of Get Smart With City Chic! Today we’re going to tackle the question everyone’s asking: is the D.C. housing market going to crash?

Let me start by saying, I am skeptical of real estate agents who are always rainbows and sunshine about the housing market. Real estate isn’t a binary thing, there is never a “great time to buy” or a “great time to sell”. It all depends on your personal circumstances. So with that in mind, here’s my real take on a potential housing crash.

Recap of the 2008 Housing Crash

I’ll keep this brief, but this is important. The last housing crash was caused by subprime and predatory mortgage lending, along with home builders and developers building like crazy. So when the Great Recession hit, it was a perfect storm. People lost their jobs, which meant they weren’t buying homes and couldn’t pay their mortgages. And because prices crashed, they weren’t able to sell them. There were way too many homes on the market. Lots of supply, plus low demand, equals party’s over.

How is this different from 2008?

We have high demand and low supply — the complete opposite of the crash.

On the demand side, the largest demographic group in the US, the Millennials, are now in their 30s and in prime home buying age. They are buying their first homes and move-up homes, which is creating a crunch across the entire housing market.

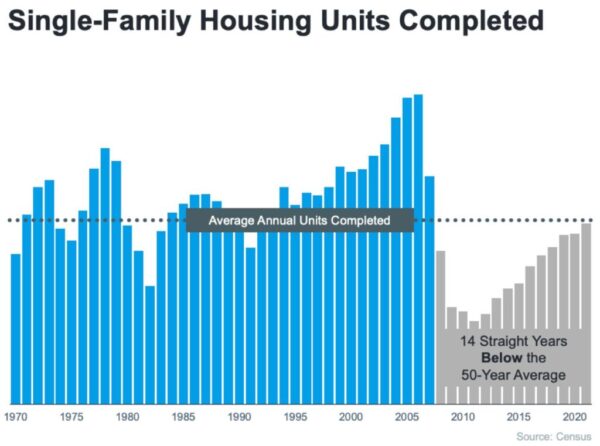

On the supply side, home building hasn’t recovered from the crash. The graph below shows how many new single family units are being built, and it definitely isn’t enough to satisfy demand. Add to that the labor shortage, supply chain issues and inflation, and we’re dealing with a very unfavorable outlook on new housing supply.