When you buy a home in Washington, D.C., in most cases the city collects a recordation tax from the buyer — 1.1% of the purchase price under $400,000 and 1.45% if the price is above $400,000.

This makes up a big portion of the buyer’s closing costs and is paid up front at closing. But it’s possible to get this tax reduced significantly for those who qualify. The D.C. First-Time Home Buyer Recordation Tax Reduction reduces this to just .725% of the purchase price. That’s some BIG savings!

How to qualify for the D.C. First-Time Home Buyer Recordation Tax Reduction:

- Buying your first home in D.C. — This is to encourage new home ownership; you cannot have owned a principal residence in D.C. before.

- The home must be your primary residence w/homestead deduction — No investment properties or second homes. You have to live there.

- Purchase price not to exceed $647,000 — Regardless of what the loan amount is, you have to stay under this price point to qualify.

- Annual household income within limits — For a single individual making no more than $154,000. For a couple, the max income is $174,780.

Want to learn more about this and other ways to save money on your home purchase? Check out our Home Buyer Tips Blog.

Recent Stories

Photo by Aimee Custis Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Mission on Saturday night (04/13) in…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3:

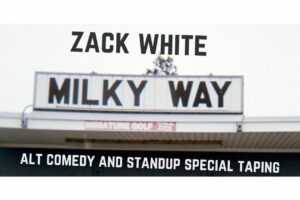

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two