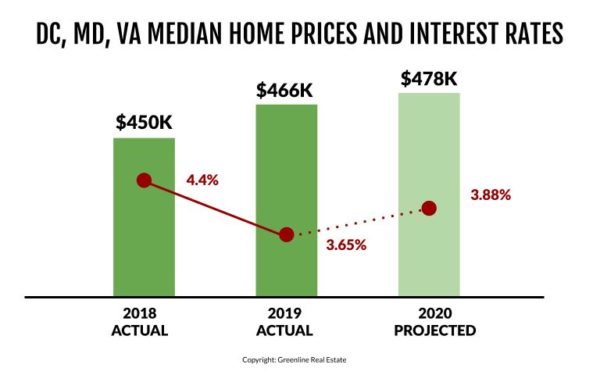

As 2019 draws to a close, we analyze the state of the DMV housing market and it’s a mixed bag — some good news for Buyers, some good news for Sellers. Low inventory and rising prices are projected for the 2020 market.

Good news for Buyers: Affordability is up. Interest rates are at historic lows and, for a 30-year fixed rate mortgage, are nearly .75% lower than they were a year ago. That’s about $150/month in savings at the median DMV home price — or $54K less in payments over the life of the loan.

Good news for Sellers: Inventory is down and prices are up. The number of new listings are down 3% versus 2018 — meaning there are more eyes on fewer properties. More Buyers combined with lower inventory fueled a 4.5% median price increase over the last 12 months. Expect price appreciation to slow in 2020 to a still respectable 2.6% regionally.

Here are some take-aways on the state of the DMV Housing Market:

- Home prices are up 4.5% year-over-year — The region’s median sales price is now $465,600. That breaks down to a median price for condos at $324,000, townhomes at $450,000 and single-family detached home prices at $561,883.

- Housing inventory is down — New active listings are down 3% from last year. That means there are fewer new listings on the market and the average days on the market for properties has also decreased to 13.

- 2020 home prices are expected to rise 2.6% — Price appreciation in the D.C. region is forecasted to be 2.6% in 2020. Of course that will differ greatly by neighborhood — but 10 years into a housing expansion, that is considerable.

- Interest rates are nearly .75% lower than last year — 30-year fixed rate mortgages now average 3.65% for well-qualified borrowers. That’s down from 4.4% a year ago. Forecasts indicate that rates will rise to 3.88% by the end of 2020.

Real estate markets are hyper localized. If you want to know what the market looks like in your neighborhood, reach out and consult a Realtor. Or learn more ways to get an edge on our Home Buyer Tips Blog.

Recent Stories

Photo by Beau Finley Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Him, dapper chap with a light…

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our