This column is written by Metro DC Houses, a local real estate team serving DC, MD, VA made up of Colin Johnson, the current President for the D.C. Association of Realtors and Christopher Suranna, the President Elect for D.C. Association of Realtors.

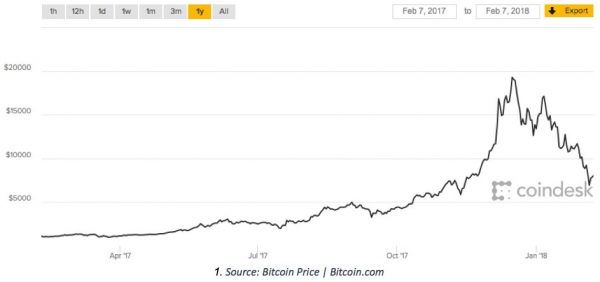

We started this article 2 weeks ago and a lot has changed, but as we try to grapple with what exactly Bitcoin (BTC) is and why everyone you know is getting rich and you’re not, it seems that the cryptocurrency’s time in the limelight has not run out.

BTC is a digital currency that is gaining acceptance as a method of payment for all sorts of online and real-world transactions. Today, over 10,000 merchants worldwide accept BTC, ranging from Microsoft and Virgin Galactic to Amsterdam coffeeshops.

Blockchain technology, which eliminates the need for a central bank to print and back the money, has sparked a revolution in how we think about currency. It was only a matter of time before this innovation spilled over into real estate with several instances all over the country of sellers accepting bitcoin as payment for the sale of their home.

However, it’s not as easy as it sounds, with the proven volatility of the cryptocurrency’s value in conventional US dollars, the 2,739 BTC which were needed to purchase a $1.6 million Lake Tahoe home in 2014 would allow you to trade for $24 million in hard cash today!

The standard contract used by many real estate professionals would have to be altered to deal with the actual exchange, as it currently notes US dollars. Due to the volatility in the currency and because a traditional purchase and sale takes 7-45 days, contract procedures would have to be modified.

Technically how would one handle this transaction? We have asked a few other real estate professionals their opinions.

Thomas Cymer, CFP® at Opulen Financial Group: “Price stability is an integral part of using a currency as a medium of exchange. In particular when the good being purchased is the biggest asset a person may have. As volatile as bitcoin has been, people should be extremely cautious when using it for a large transaction like a home and better yet avoid it altogether.”

Jeff Stempler, lender at HomeBridge Financial Services, Inc. on the viability of using bitcoin exclusively for down payment and closing costs: “FHA will not permit bitcoin at all. FNMA/FHLMC will allow but only if we can document liquidation and can show ownership of the account and 30-60 day history (as determined by DU). The trouble with these is that you cannot always document ownership of the account or a history. If you can, then you can use for FNMA/FHLMC.”

Scott Sweitzer, Esq., owner of Prime Settlement: “If a seller wants to receive payment in BTC, the contract would need to have a mechanism that would allow for valuation in US dollars for title policy/transfer tax purposes. Additionally, enough BTC would need to be converted to US dollars to pay the title company/local jurisdiction, plus any other closing costs (including payoffs) out of settlement proceeds.”

Stephen Littlewood, CPA at Littlewood and Associates on how this relates to your taxes: “Buyers paying with BTC must recognize the basis and the gains or losses on their returns. According to the IRS, BTC is considered real property. They will be taxed for their gain or recognize the loss on Schedule D on their personal return. As for the seller, the bitcoin received becomes the basis of the new property. Then when it’s liquidated or they decide to buy something with bitcoin, then the cycle happens again.”

Could you do it? It doesn’t look impossible, but not without some creative mechanisms in place; plus, finding two people to agree to all of the unconventional solutions may be more difficult than it’s worth.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our