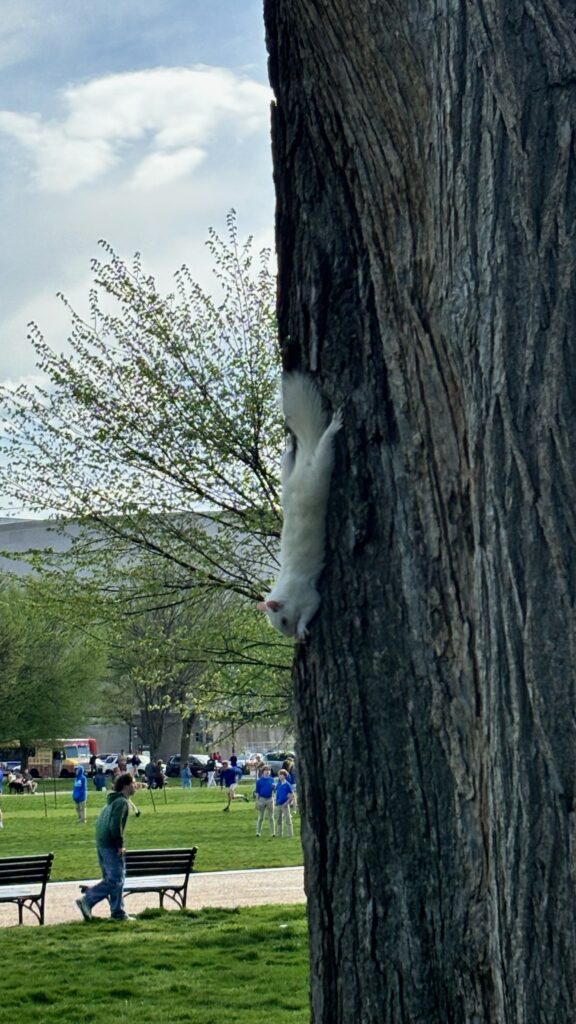

Photo by PoPville flickr user Erin

“Dear PoPville,

I’ve been having a dispute with the Office of Tax and Revenue that I hope your readers can help me with. Basically, I have two questions:

1. When OTR disagrees with what I reported on my tax return and says I owe money, what are the exact names of documents it sends send to try to get it, and in what order does it send them? When do they resort to something more forceful like garnishing my paycheck or offsetting a subsequent year’s refund?

2. Has anyone ever had to challenge OTR’s refusal to allow the Schedule H credit, which is a credit for taxpayers to take a credit based on the amount they paid on their household rent or mortgage?

I claimed the credit on my 2014 taxes and expected a refund as a result. Last year, I was a student with an adjusted gross income of about $12,000 because I was living off student loans (which don’t count as income on your tax return).

When I didn’t receive the anticipated refund, I called OTR to inquire. A customer service representative said they disallowed the credit because my rent was higher than my income. Yes, it was, but I’ve been researching this issue and I think it doesn’t matter which is higher, according to the D.C. Code. (If anyone wants to check, it’s D.C. Code § 47–1806.06, available at http://dccode.org/simple/sections/47-1806.06.html.)

When OTR sent me a bill, I filed a protest at the Office of Administrative Hearings. OTR’s attorney told me he thinks OAH doesn’t have jurisdiction because it can only hear protests of a Notice of Deficiency, and the document I received was called a Notice of Correction and Tax Bill. (D.C. Code § 47–4312 gives OAH jurisdiction to hear taxpayer protests. It’s at http://dccode.org/simple/sections/47-4312.html.)

This sounds like a distinction without a difference. Are these actually different documents? If I ignore the notice of correction, is OTR eventually going to send me a notice of deficiency?

Does anyone out there have experience with challenging OTR’s refusal to allow this credit?”

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our