Photo from PoPville flickr user julianne’s

Griffin & Murphy, LLP, is a boutique law firm in Washington, D.C. concentrating its practice in real estate law (including development, finance, leasing, zoning and condominium conversions), as well as estate planning and probate, civil litigation, and business law. The attorneys of Griffin & Murphy, LLP are licensed to practice law in the District of Columbia, Maryland and Virginia. Griffin and Murphy, LLP was founded in 1981.

Please send any legal questions relating to real estate, rentals, buildings, renovations or other legal items to princeofpetworth (at) gmail (dot) com, each week one question will be featured. Ed. Note Griffin & Murphy is a PoP advertiser. You can find previous questions featured here.

QUESTION

So the new weekly legal question feature on top of today’s question about DIY wills has me thinking. I’m in a position I bet others are in: I bought my house before I was married, so the title is in my name only, but I’d like to add my wife’s name to the title just in case … you know … the Yakuza gets the jump on me or something. In other words, I want her to own the house outright without having to take it through probate if something happens to me. I don’t want, however, to pay transfer taxes or new title insurance or any of the things that cost so much at closing to accomplish this. Is there an easy and cheap way to do this?

Don’t know if this really is something others would be interested in, but I sure would.

ANSWER

Thanks for sending us a relatively easy question this week! We will reciprocate by giving you some good news. We are happy to report that adding your wife to your title should be relatively easy and inexpensive.

Continues after the jump.

Transfers of real estate between husband and wife in the District of Columbia are not subject to either transfer or recordation tax. There will be a modest fee of between $25 and $35 charged by the Recorder of Deeds to record the new deed.

What you need is a deed from yourself as Grantor that conveys the property to yourself and your wife as Grantees, and the deed should provide that you and your wife take title to the property as Tenants by the Entirety (“T/E”). This is a type of tenancy that provides that, upon the death of one spouse, the surviving spouse takes the whole of the property without any further action being required; in other words, title to the whole of the property passes by operation of law to the surviving spouse. Only married persons qualify to hold title to property as T/E. There are special and very strong protections that result from the creation of a T/E tenancy. For instance, the creditor of one spouse may not attach the property owned by both spouses as T/E or attempt to divide the property for purposes of attachment. A T/E tenancy cannot be terminated except by the action of both spouses, their divorce or the death of one of them.

You should go back to the title company that issued your title insurance policy and make sure that conveyance of the title to your property to you and your wife as T/E will not negatively affect your title insurance policy. I doubt that this would be the case, but better to be safe than sorry. The title company can also prepare the necessary deed and the cost for doing so should be modest. The title company can also take care of recording the deed for you.

This response was prepared by Mark G. Griffin and Patrick D. Blake of Griffin & Murphy, LLP. The material contained in this response has been prepared for informational purposes only and should not be relied upon as legal advice or as a substitute for a consultation with a qualified attorney. Nothing in this response should be considered as either creating an attorney-client relationship between the reader and Griffin & Murphy, LLP or as rendering of legal advice for any specific matter.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

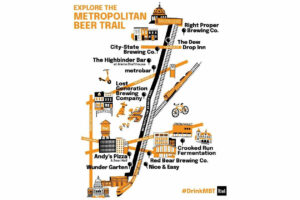

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

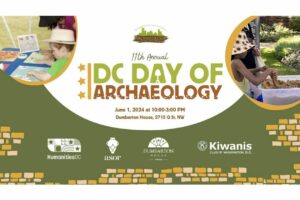

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our