Hipchickindc (aka Suzanne Des Marais) is an associate broker with The Bediz Group, LLC at Keller Williams Capital Properties . Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system and/or Real Estate Business Intelligence (RBI). Information is deemed reliable but not guaranteed.

Featured Property: 1421 Columbia Rd NW #B2

Legal Subdivision: Columbia Heights

Advertised Subdivision per Listing: Columbia Heights

Bedrooms: 1 Baths: 1 Parking: “Other” (yes, it says this in the listing) Ownership: Condo

Monthly Condo Fee: 123.00 Square Footage per Listing: 430

Original List Price: $299,000.

List Price at Contract: $245,000.

List Date: 09/10/2015

Days on Market: 243

Settled Sales Price: $220,299.

Seller Subsidy: $0.

Settled Price per Square Foot: $512.

Settlement Date: 06/29/2016

Transaction type: REO/Bank Owned

Note that this is not the subject property, but another unit in the building was a GDoN post in November 2015: here.

The listing can be seen here: here.

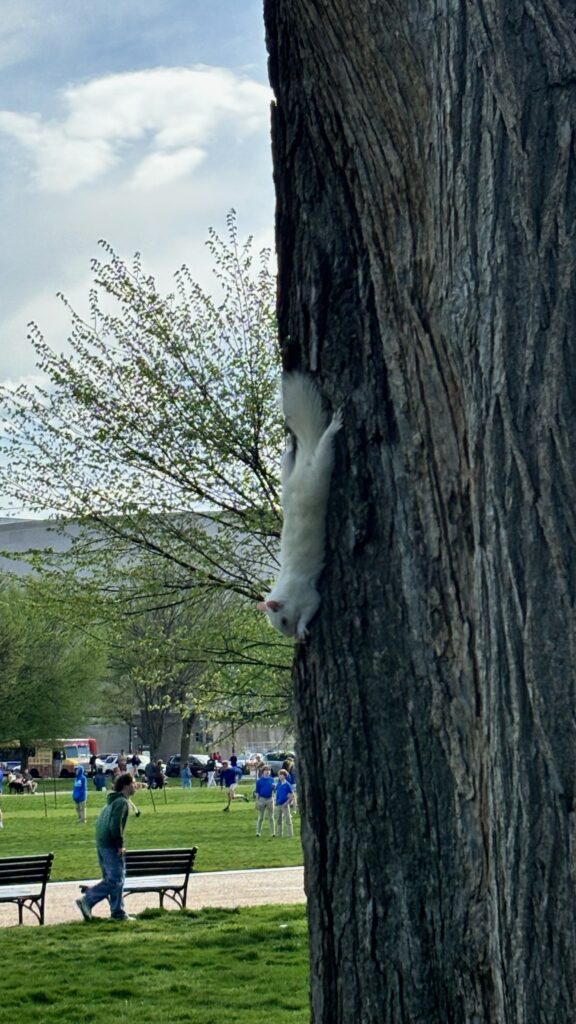

This recent sale did not start out as a GDoN (Good Deal or Not) post, however, I stumbled upon it while following up on another unit that was a GDoN in the same building. It seemed like an opportunity to write about a rare bird in DC…the foreclosure sale.

It’s still a heavily weighted Seller’s market out there with less than two months worth of active listing inventory at any given time (a balanced market is considered six months worth of inventory, which refers to the amount of time it would take at the current pace of the market to absorb existing inventory). That said, “Good Deals” are all relative to the conditions of the market. As agents, we still get inquiries from buyers looking for deals and the question, “what about foreclosures?”

By the time a property is listed as a foreclosure sale on the multiple listing service, the original owner is completely out and the bank that holds the mortgage has taken ownership (as opposed to a short sale, where the owner is still in the picture). The important thing to note is that you’re not dealing with a person on the other side of a sale like this, but with a corporation. Subsequently, the transaction is very process and numbers driven. Things do not happen quickly.

Asset managers at banks rely on something called a Broker Price Opinion or BPO to determine the list price of the REO (real estate owned by the bank). The asset manager may be in another part of the country and will likely have never seen the property. The property will be physically managed by shutting down all utilities and secured, the listing will go on the multiple listing system, and buyers have the opportunity to submit an offer through an online site. Oh, and banks have weird rules. It notes in the remarks to agents on this listing “Buyer responsible for utilities at inspection” (meaning the buyer has to pay to start accounts to set up utilities on a property they don’t own in order to do an inspection), and in this case there are additional instructions with regard to the water, “only air compression test allowed”.

Yes, but was it a good deal? The subject property is a 430 square foot 1 bedroom basement unit that settled at $512. per square foot. The next most recent listing to sell in the building is the one linked above from the GDoN post, of a third floor 800 square foot 2 bedroom unit that settled in December 2015 for $406,500. or at $508. per square foot.

In case you’re curious about active listings in DC that are potential short sales or foreclosures, you can see the current list here.

The listing agent for this sale was David Sweeney with Owners.com. Kathi Higdon-Kershaw with Evers & Company Real Estate Inc. represented the Buyer.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our