Hipchickindc (aka Suzanne Des Marais) is an associate broker with Bediz Group, LLC at Keller Williams Capital Properties . Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system and/or Real Estate Business Intelligence (RBI). Information is deemed reliable but not guaranteed.

Featured Property: 2032 Belmont St NW #132

Legal Subdivision: Kalorama

Advertised Subdivision per Listing: Kalorama

Bedrooms: 0 Baths: 1 Parking: Street Ownership: Condo

Square Footage: 386 square feet Monthly Condo Fee: $272.71

Original List Price: $224,900.

List Price at Contract: $224,900.

List Date: 02/25/2016

Days on Market: 6

Settled Sales Price: $224,900.

Seller Subsidy: $1000.

Net Price per square foot: $580.

Settlement Date: 04/30/2016

Transaction type: Standard

Original GDoN post is: here.

The listing can be seen here: here.

This unit is located in one of Kalorama’s numerous high rise buildings surrounded by trees and green space. Tucked away from the hustle and bustle, this area is not far from Adams Morgan restaurants and bars, Rock Creek Park, Woodley Park, and (north) Dupont. The Valley Vista condominium is a large building, with 169 units, built in 1928.

Since the beginning of 2016, there have been a total of 89 settlements of studio units that are condo ownership in all of DC. These range from a 264 square foot unit on Irving Street NW in Columbia Heights that sold for $111,000. (list price at $99,900.) to a 600 square foot high rise loft space on New York Ave NW that sold for $399,900. This time last year, there were only 57 studio condos settled to date. Median time on market for studio units in 2016 so far is 16 days, so they tend to move quickly.

In contrast, there have been well over 400 one bedroom condo units settled throughout the city since January 1st 2016, and at least 400 two bedroom condo units sold in NW alone during that time.

You can see currently active studio units available here

The listing agent for this sale was Vanessa Patterson with Berkshire Hathaway Home Services Pen Fed Realty. Jeff Wu with Keller Williams Capital Properties (per above disclosure, the same brokerage firm as the writer) represented the Buyer.

Recent Stories

Photo by Aimee Custis Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Mission on Saturday night (04/13) in…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3:

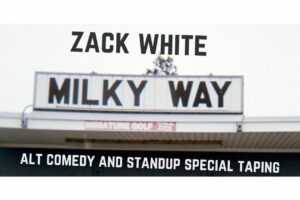

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two