via apartments.com

From an email:

“For years, the D.C. rental market has been best known for fast-rising rents – but it looks like that might finally be changing.

According to the inaugural D.C. Rental Market Snapshot, released today by Apartments.com, the balance of power in D.C. is beginning to tip in renters’ favor. Here are a few of the reasons why:

Inventory is way up. A recent surge in supply – owed to the development of 15,500 new apartment units in Washington last year – has led to rents rising by just 1.4 percent from July 2014 to July 2015. That’s significantly less than the national average increase of 3.9 percent.

There’s a “flight to quality” happening in the market. Property owners are loading up on attractive amenities like rooftop pools, dog-washing stations and private theaters to make their units stand out in a crowded market. That means renters are finding themselves with more (and better) amenities than ever before.

Renters can score valuable incentives from buildings trying to lease-up. While move-in incentives are drying up in a lot of markets, D.C. renters can still find buildings that will offer as much as two months of free rent for new lessees.

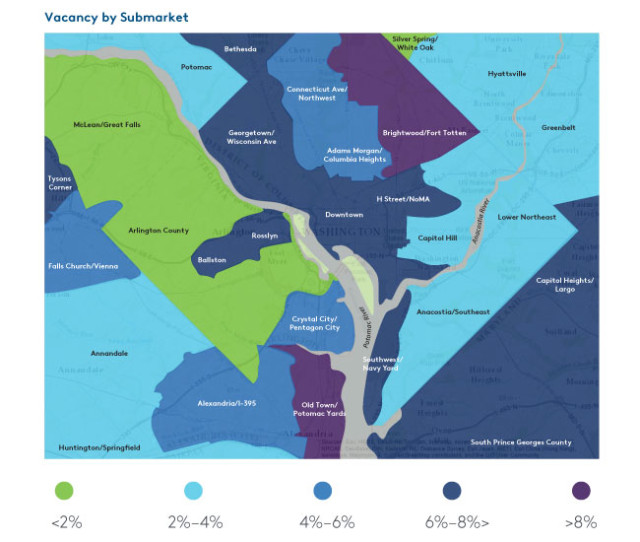

Renters have a menu of neighborhoods to choose from, each with its own unique market dynamics. Up-and-coming neighborhoods like Shaw, the H Street Corridor and Navy Yard are filling up fast, with vacancy rates dropping 5 percent since last year.”

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our