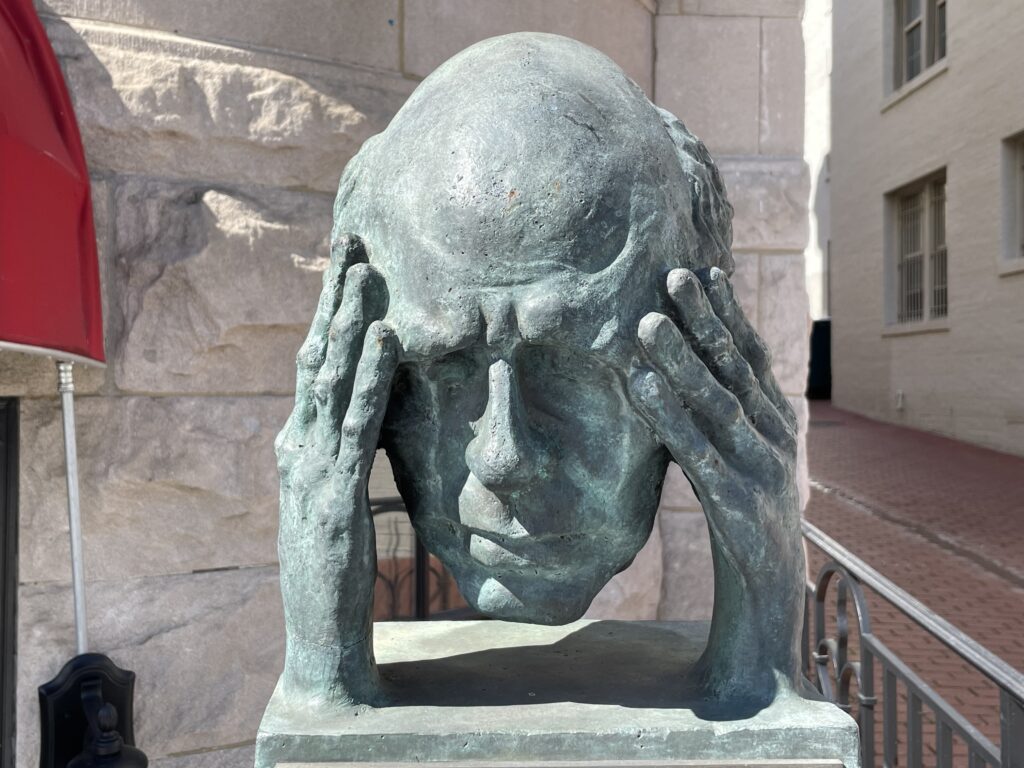

Photo by PoPville flickr user Peter Bjork

In August a reader wrote in sharing their Lessons of a Bad Home Purchase. WAMU did a follow up report this morning that is incredibly depressing:

“An October 2014 inspection of the house by Delaine Englebert, an illegal-construction inspector at DCRA, confirmed that there were numerous problems. She catalogued three dozen violations, including unpermitted work, unfinished inspections, insufficient fire-blocking throughout the house, new structural beams that are not properly supported, a deck not correctly attached to the home, a failure to insulate the house, and more.

To make the house livable again, Landis estimated the couple would have to spend $407,000 to correct all the existing deficiencies and code violations.”

Read the full report here (Part 1 of 3).

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our