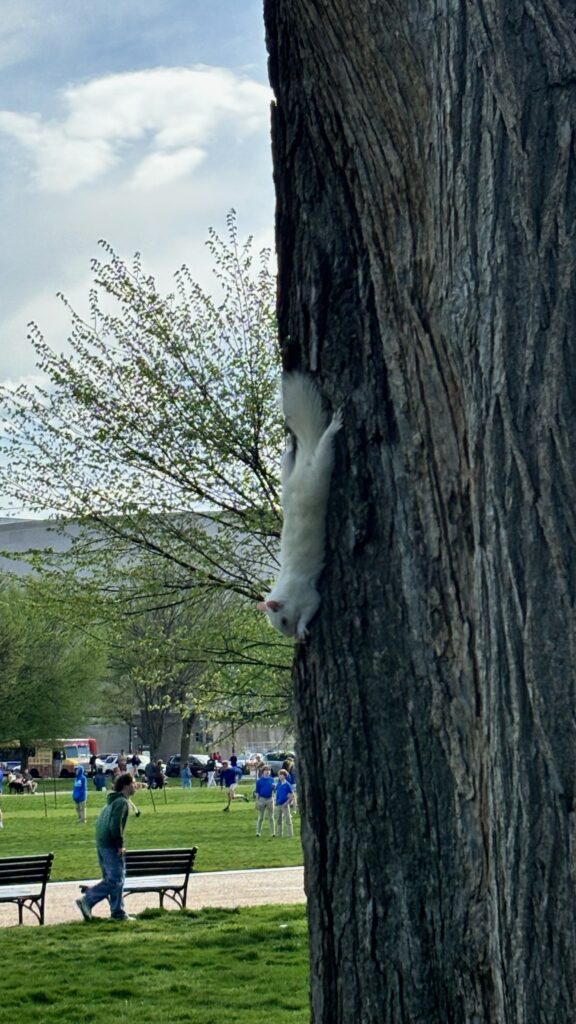

Photo by PoPville flickr user Jim Havard

“Dear PoPville,

As an Airbnb host, I just received this announcement that effective 2/15/15, Airbnb will charge guests 14.5% “transient lodging tax”. As a Host in DC, I’ve reported annual revenues on taxes, kept my head down, paid attention to how various jurisdictions have been navigating code, tax issues. It seems DC has taken a more constructive approach then, say, NYC but I suppose time will tell how it impacts overall bookings, how the hotel industry might respond in DC, and whether this really does clarify murky tax policy enough to prevent potential headaches down the road with DC tax authorities (unrelated experiences leave me wary). I wonder what others think, have heard?”

I’d be curious to also know how many folks here rent out rooms through airbnb? Will this change make you rethink it?

Letter from Airbnb after the jump.

We’re pleased to announce that we’ve been working with the District of Columbia on an occupancy tax collection and remittance program which will be launching on February 15, 2015.This program is designed to make collecting and remitting taxes easier for Airbnb hosts. When we collect this tax from guests on your behalf, it won’t affect your payouts. Just like before, you’ll receive your accommodation fee minus the 3% Airbnb host service fee.What is changing?

- For reservations in the District of Columbia booked on or after February 15, 2015, guests will see a line item for the district-imposed 14.5% Transient Lodging Tax. The tax will be added to the total amount paid by guests of the District of Columbia on stays of less than 91 days – hosts will not have to do anything extra.

- If you’ve already been collecting the District of Columbia Transient Lodging Tax from Airbnb guests, you should not do so after February 15, 2015.

The Airbnb community contributes substantial, positive economic impacts in neighborhoods across the District of Columbia, and this initiative will continue to make the community even stronger.We’ve posted more information about this announcement on our Public Policy blog and we hope you’ll check it out. To learn more about how taxes work for Airbnb hosts, please visit our Help Center.Washington, D.C. is a great place to call home and we look forward to continuing to work with everyone here to make it an even better place to live, work and visit.Thanks,

The Airbnb Team

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our