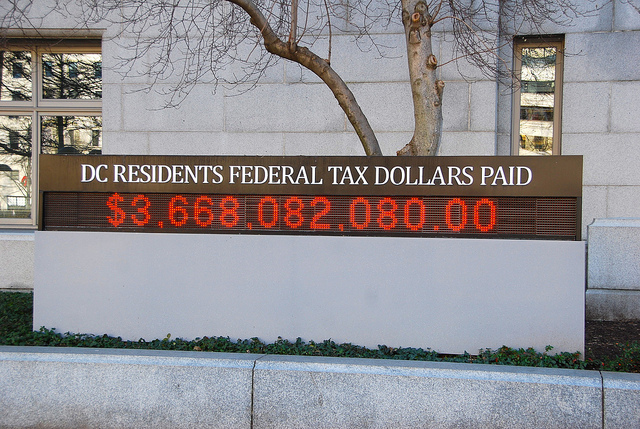

Photo by PoPville flickr user afagen

“Dear PoPville,

My husband and I just got married this year. We also bought a condo together this year and did some renovations on it. Additionally, I have significant student loans and I am currently participating in the Public Service Loan Forgiveness program and making income-based payments. All of this is a long way of saying that we think this is finally the year where seeing a tax professional is probably worthwhile, since we’re not sure Turbotax can walk us through our best options here. Do you or might any of your readers have recommendations for a tax professional for us to go see? Our coworkers and friends mostly seem to use Turbotax or do their taxes themselves, but especially with my student loan situation (which presents a question of whether it’s better to file jointly or married filing separately) we feel like a professional would really help but we don’t know where to start in finding someone good.”

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3: