1115 Pennsylvania Avenue, SE

A reader sends these heart breaking photos of Frager’s this morning. Last night Frager’s wrote:

“Yes, there was a fire at Frager’s. Everyone got out safely, and we are grateful for that. We will get together tomorrow and figure out how to proceed after this terrible fire, but we want to thank you for all your emails, web submissions, and above all, the hugs from so many who we met after the fire. Please stay with us while we sort this out, and thanks!”

For those who want to help, a reader sends:

Tax-Deductible Fund for Frager’s Hardware Fire

The Capitol Hill Community Foundation has set up a donation fund for Frager’s. Contributions are TAX-DEDUCTIBLE.

From their website:

Frager’s Fund Needs Your Support

A special fund is being created to provide help as needed in the aftermath of the June 5th Frager’s Hardware Fire. To make a contribution, click on the Donate button and write “Frager’s” in the Dedication section.

From DDOT:

The District Department of Transportation (DDOT) and the Metropolitan Police Department would like to inform the public that the following streets will be closed due to a structure fire in the 1100 block of Pennsylvania Avenue, SE.

· Pennsylvania Avenue from 10th to 12th Streets, SE (eastbound closed)

· 11th and 12th Streets (northbound) at G Street, SE

· E Street at 10th Street, SE**Pennsylvania Avenue (westbound) is open**

Ed. Note: Huge props and respect to the firefighters who battled the four alarm fire. Two firefighters were injured. Wishing them a speedy recovery.

Thanks to all who emailed photos to my princeofpetworth(at) gmail account, tweeted updates to @PoPville, and uploaded photos to the PoPville flickr pool.

Looking forward to posting about rebuilding plans soon.

Update from Matchbox:

In light of the devastating fire at Frager’s Hardware near Eastern Market, the Barrack’s Row location of matchbox (521 8th Street SE) will host open interviews for employees and neighbors affected by the fire and who are in need of temporary work. From 2pm to 5pm this afternoon matchbox management, led by Fred Herrmann, Vice President of Operations for the local restaurant group, will host interviews for all interested candidates affected by the fire.

“Frager’s has been a part of our community for longer than most of us have been here. We want to do what little we can to help alleviate the pain the store’s employees and families are already experiencing, and intend to continue our help for as long as and in whatever ways possible,” Herrmann said.

The recent addition to the board of Restaurant Association Metropolitan Washington, Herrmann plans to involve the restaurant group in the reconstruction in whatever capacity possible after the damage has been assessed and employees are placed in ongoing work.

Recent Stories

Photo by Aimee Custis Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Mission on Saturday night (04/13) in…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3:

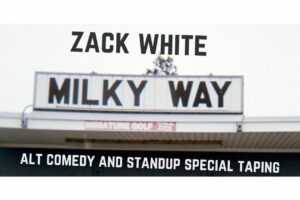

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two