Hipchickindc is a licensed real estate broker. She is the founder of 10 Square Team and is affiliated with Keller Williams Capital Properties. 10 Square Team is a princeofpetworth.com advertiser. Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system. Information is deemed reliable but not guaranteed.

Featured Property: 2010 1st St NW

Legal Subdivision: LeDroit Park

Advertised Subdivision per Listing: Bloomingdale

Original List Price: $759,900.

List Price at Contract: $759,900.

List Date: 04/12/2012

Days on Market: 5

Settled Sales Price: $800,000.

Settlement Date: 05/30/2012

Seller Subsidy: $1,500.

Bank Owned?: No Short Sale? No

Type Of Financing: Conventional

Original GDoN post is: here.

The listing can be seen: here. The virtual tour is here.

In full disclosure, this was my listing and it happens to be on the same street just a few blocks south of the other listing that I represented and profiled back in late December 2011.

I had sold this property to the recent sellers back when there actually were foreclosures to sell in DC in 2009. At that time they lived across the country but had come to DC several times for intensive house hunting trips. They had a very specific type of home that they were searching for (ideally Victorian style, with some historic details remaining, and in need of restoration/renovation).

They were on the west coast when this home came on the market in 2009, so I took lots of photos and they ended up making an offer without actually getting into the house. Given that it was a foreclosure, there were several other offers in and there were a bunch of hoops to be jumped through. I recall driving out to Sandy Spring, Maryland to the listing agent’s office to hand deliver the contract. Then we waited. From listing to acceptance of the contract took several weeks, which allowed the then-buyers plenty of time to fly in and check out the house in person. Here’s the listing link to the “Before” picture.

What I love about this listing is that it was restored and renovated by owner occupants rather than investors. They addressed details that are often obliterated by developers due to cost. For example, they had the historic tiles in the fireplace mantels and the vestibule custom matched by an artisan. The skylight was restored as they are rarely seen anymore, with colored glass bordering the clear central piece. Anybody with a turning staircase will appreciate this one…the interior stair railing to the second floor was designed to be simply dismantled to make it much easier to move furniture upstairs. Other unusual details not likely seen in an investor renovation include the European stove, attic storage, tankless hot water heater, the elevated deck with parking for two cars underneath, and (one of my favorite things about this house) extensively restored heart of pine floors throughout both the main and the second floor.

We ended up with two contracts in hand by midnight of the Thursday the property was listed. Per the owners’ request, there was no open house. By the time we reviewed contracts on Monday, there were four offers, hence the strong escalation above the listed price.

Recent Stories

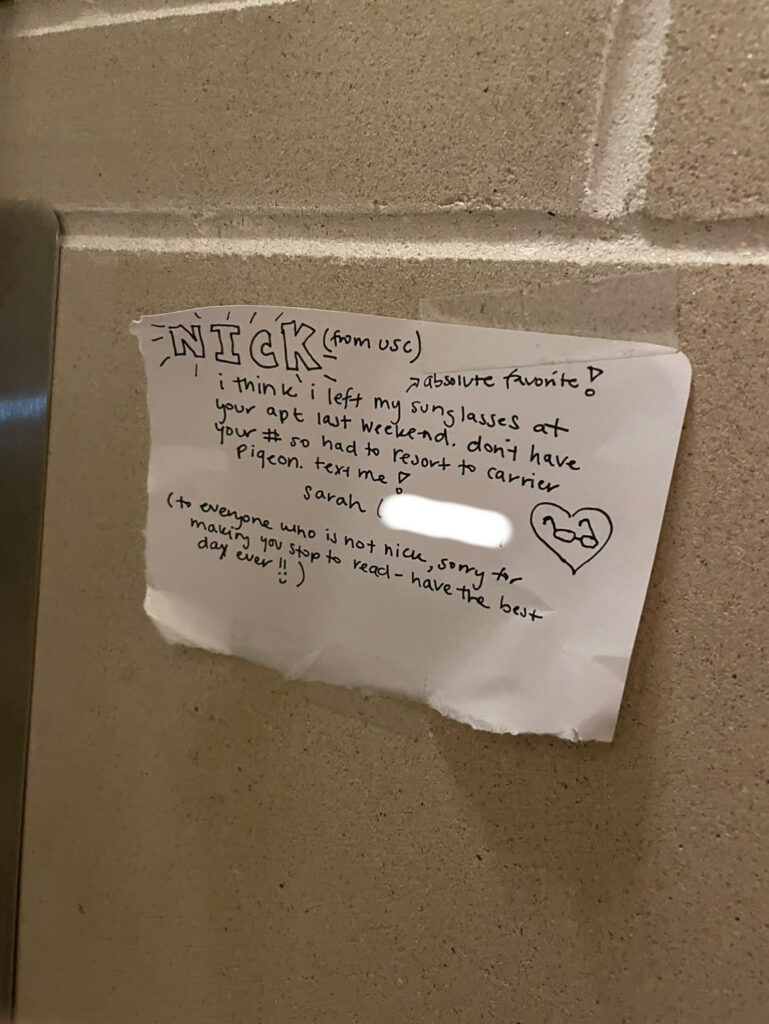

Thanks to Alex for sending from Adams Morgan. Nick, if you have Sarah’s sunglasses – email me at [email protected]

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

DC Labor History Walking Tour

Come explore DC’s rich labor history with the Metro DC Democratic Socialists of America and the Labor Heritage Foundation. The free DC Labor History Walking Tour tour will visit several landmarks and pay tribute to the past and ongoing struggle

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy