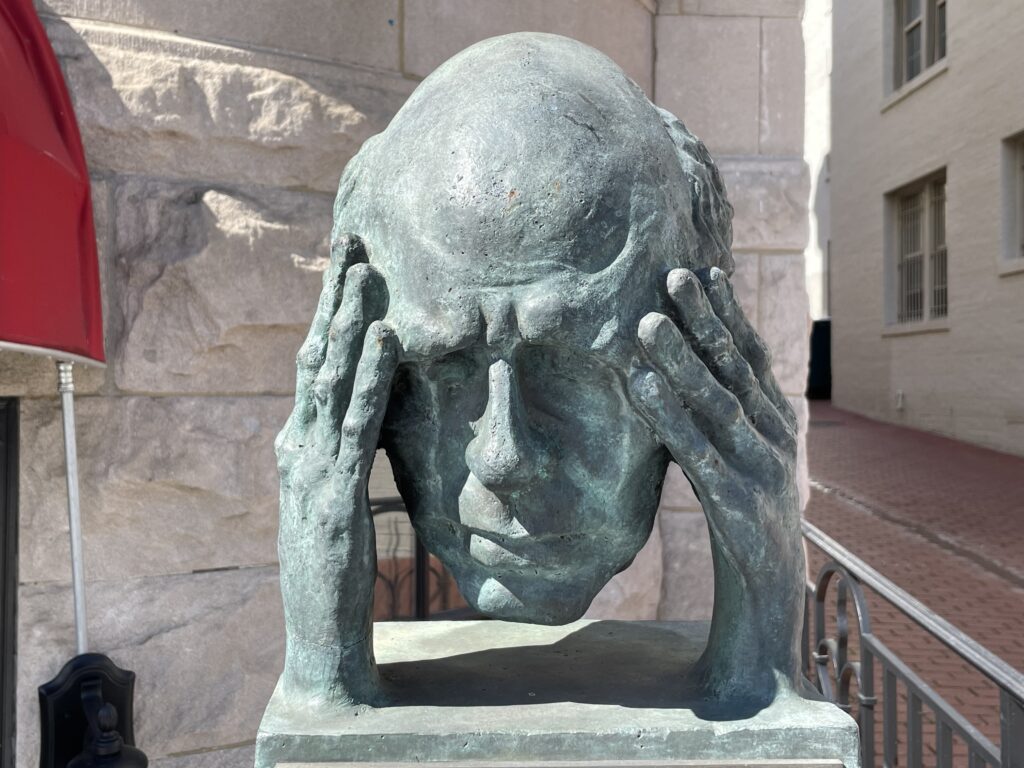

Photo by PoPville flickr user philliefan99

From Congresswoman Norton’s press release:

Congresswoman Eleanor Holmes Norton (D-DC) plans to offer an amendment on the House floor next week to the surface transportation bill, H.R. 7 (American Energy and Infrastructure Jobs Act of 2012), to encourage commuters to use mass transit by equalizing tax benefits for mass transit and parking, which had been the case until American Recovery and Reinvestment Act funding expired this year. Currently, commuters receive up to $240 a month for driving their personal cars to work and up to $125 a month for taking mass transit. Norton’s amendment would be retroactive to the beginning of the year.

“It is insane to incentivize by almost two to one the use of cars over mass transportation to get to work,” Norton said. “At the very least, we should level the playing field by giving commuters the same tax benefits for using public transportation as for driving. My amendment, of course, applies nationwide, but without it, the effect in this region, where traffic congestion is already a crisis issue, could become catastrophic. Some do not care as much about the serious health and environmental effects as I do, but everybody cares about being stuck in traffic.”

Norton also said that with mass transit fares continuing to rise here and throughout the nation, and ridership declining from the recession, now is not the time to lower the benefit. Norton is opposed to the underlying bill and voted against it in the Committee on Transportation and Infrastructure, but said she is planning to offer the amendment so at least some good would come from the legislation if it passes.

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our