Photo by PoPville flickr user philliefan99

“Dear PoPville,

Held Hostage by the American Dream, Home Ownership

I can’t be the only one this has happened to so I’m writing to get advice and to find out what others have done in similar situations. I have a rental property that I formally lived in (bought in 2003) and had to move from due to family issues. I bought another house (in 2008) that I currently live in and I have been renting out the original house since then, mostly at a loss, since it’s been upside down in the current market.

The first tenants were great and I was happy despite the loss. Those tenants moved for work. The tenants that live in the rental house now, haven’t been as easy or pleasant. Additionally, in this market the rent continues to cover the mortgage less and less so that I’m losing more and more. I’ve also hired a prop manager and so I’m losing, still, more. I’m pretty unhappy with the prop manager anyway. So the situation is that the tenants are difficult, the property manager is inefficient enough so that I’m still dealing with the rental house almost every day, and with the diminishing rental income the mortgage is no where near getting paid for without me personally subsidizing it every month.

At this point, I am losing a significant amount of money each month (and sanity) and trying to figure out what to do with this rental property – a short sale seems so unlikely and long term, especially with these tenants in the house. If the tenants are out of the house (ideal for selling), then how can I afford both mortgages, does that mean foreclosure for sure? Everyone talks about stopping the payment of the mortgage to the rental house but that seems like a road once started you can’t change.

I’ve tried several recommends on attorneys to get guidance but have gotten no where. Very few will return calls and so many are either title attorneys or landlord/tenant attorneys. They really have no practical experience with “investment” (hardly my idea of the word) properties. Any of the short sale attorneys I see online and one I’ve talked to personally seem to be bankruptcy attorneys and so far seem to push that – which is not where I’m hoping to go. Who can I talk to without paying $300/hr to find out if I believe in the attorney or not. Who else out there has gone through this? It feels like I’ll have to jump off and learn the hard way since I can’t get any decent answers up front.”

Recent Stories

Photo by Aimee Custis Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Mission on Saturday night (04/13) in…

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3:

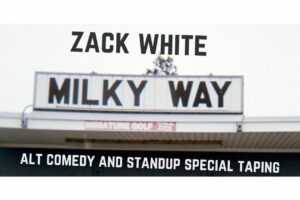

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two