A PoPville twitter reader writes:

“With Park Triangle in Columbia Heights up for sale, can you point readers to what happens if an apartment building goes condo?”

The reader is referring to a Washington Business Journal post:

Park Triangle, a luxury apartment complex in Columbia Heights that was completed in 2006, is on the market.

Jones Lang LaSalle Inc. is marketing the 117-unit building on behalf of its owner, Mid-Atlantic Multifamily Group. The building also includes 18,500 square feet of ground level retail space at 1370 Park Road NW.

This is the building above the Columbia Heights plaza.

We had a similar discussion when the nearby Allegro was foreclosed and later sold.

For the Park Triangle building I would be very surprised if the new owners immediately convert it to condos, I’d guess it will remain rentals. But just out of curiosity – does anyone know what happens when a rental building is converted to condos? Does the tenant get first dibs at a purchase?

For those who live at the Allegro and stayed through the sale – did you notice any changes? Was your rent raised/lowered?

Recent Stories

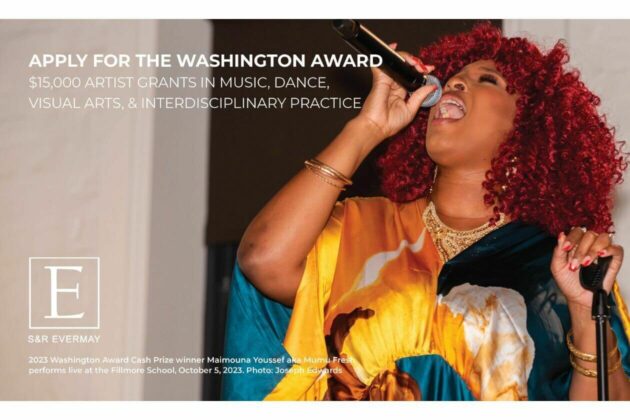

We are excited to announce that the 2024 Washington Award application opened today!

The 2024 Washington Award offers four cash prize awards of $15,000 for individual artists working in the field of music, dance, visual arts, and interdisciplinary practice (one award per category). This award, one of the largest grants in D.C. available to individual artists, provides unrestricted cash support to artists at critical moments in their careers to freely develop and pursue their creative ideas.

Since its inception in 2001, the Washington Award has recognized artists in music, dance, interdisciplinary practice, and visual arts. In a renewed commitment to supporting the artistic community of Washington DC, the Washington Award is eligible to DC artists who prioritize social impact in their practice.

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

DC Labor History Walking Tour

Come explore DC’s rich labor history with the Metro DC Democratic Socialists of America and the Labor Heritage Foundation. The free DC Labor History Walking Tour tour will visit several landmarks and pay tribute to the past and ongoing struggle

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy