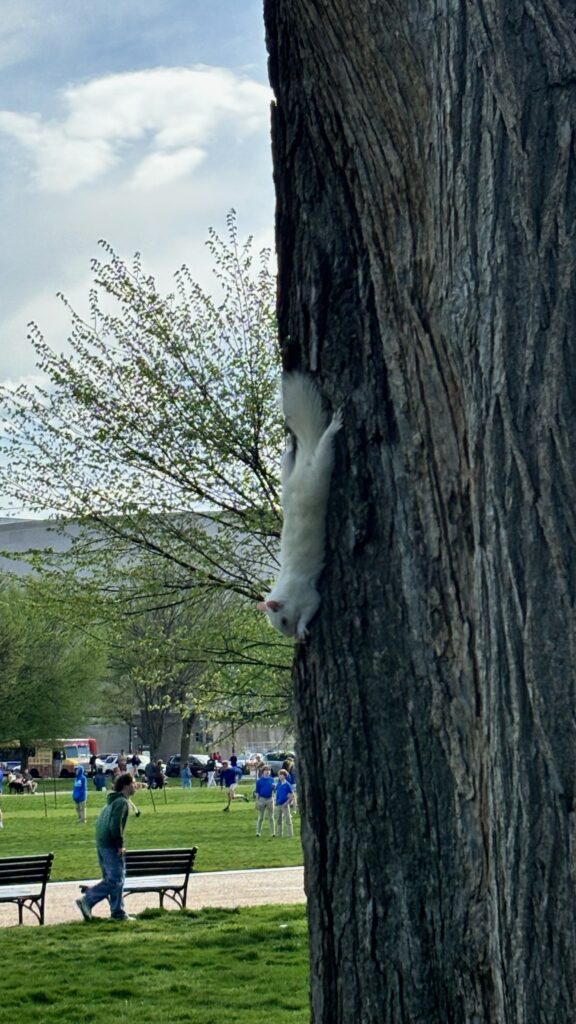

Photo by PoPville flickr user Madame Meow

“Dear PoP,

So we bought our house in the in the Capitol hill area in late 2009, and we just got our 2012 property tax assessment, our second increase since we bought the place. I’m contemplating appealing, but not sure it’s worth the effort, and/or wondering if it’ll do more harm than good.

The current assessment is an increase of about 2.6%, bringing the assessed value up to about 3.6% more than we paid for the place about 1.5 years ago. I’ll admit this seems far from extreme, but when I take a look at Zillow for example, it shows 20002 down ~6% in the last year and “Near Northeast” down ~3.5%. I wander through the occasional open house and look at listings and my feeling about local prices is that they’ve been flat at best, if not slightly down as Zillow suggests.

So do I have grounds for an appeal? Should I bother? Do you have any idea how detailed their analysis really is? Do they actually go street by street, house by house, or do they just apply a percentage for each neighborhood based on some coarse measure?

We’ve made some improvements to our house. One of the neighbors just went through a very serious renovation and their property value has clearly gone way up. In reality mine has certainly gone up too as a result, probably more than the assessment shows, though I think it’s been too recent to actually make its way into this assessment. If I appeal will I end up with more focused scrutiny and end up doing myself more harm than good?”

I thought that it would be a good idea to appeal if your house (in similar condition) was assessed at a much higher value than homes nearby. I once appealed on those grounds a couple of years ago and won the appeal.

We discussed how tax assessment works here and discussed an appeal here and here.

Did anyone else’s assessment increase?

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our