Photo by PoPville flickr user Bogotron

“Dear PoP,

This is probably more of a high school math assignment type of question – but I must have missed that day! I’m the type that got straight A’s in college calculus but can’t compute a math problem needed for practical use! So, HELP — how do I do this??

CALCULATING A HYPOTHETICAL PRESENT-DAY BALANCE HAD A SECURITY DEPOSIT BEEN PLACED IN AN INTEREST-BEARING SAVINGS ACCOUNT WHEN RECEIVED 13 YEARS AGO. . .

DC Housing Regulations state that when a Landlord received a security deposit from a new tenant, that deposit should be placed in an interest bearing account (the total of which + interest ideally would be returned to the tenant in the future upon vacating the unit and assuming no deductions for repairs or damage would be taken).

OK, I admit I didn’t do that 13 years and 1 month ago. In Sept 1997, my tenant gave me $675 for a security deposit. I probably paid bills with it. Had I deposited that money in a dedicated interest-bearing savings account at that time, what would the account balance be today, attempting to account for daily compound interest? (I opened a new “Escrow Savings” account with my bank today to do this the right way with my new tenant. The daily compound interest rate today (Nov. 4, 2010) is 0.05%.)

a. If attempting to get by with estimating: Even assuming that the daily compound interest rate was the same for 157 months (13 years + 1 month) at 0.50% (which it was not)….but for argument’s sake say it was…..how do I calculate what $675 would be worth 157 months later at that rate?

b. If attempting to be accurate, is there an online calculator available that is already programmed with every daily compound interest rate since the beginning of time, enter an amount at a certain date and ask for a projected total at a specified future date? Or for accounting purposes, do they roll up daily compounded interest into a yearly average and plug in the formula 13 times….? _(*^&$^&

For me, this goes into the “too hard” pile, but I need to at least show my due diligence in making this calculation since I didn’t place the security deposit on interest like I should have done. What do other landlords do in this situation….or what would a law firm require should it be an issue? Thanks for your assistance!”

Oh man, my head just exploded. But I have faith in PoPville – can anyone do this calculation? Def. a free PoP t-shirt to whoever is first in getting a proper answer here.

Recent Stories

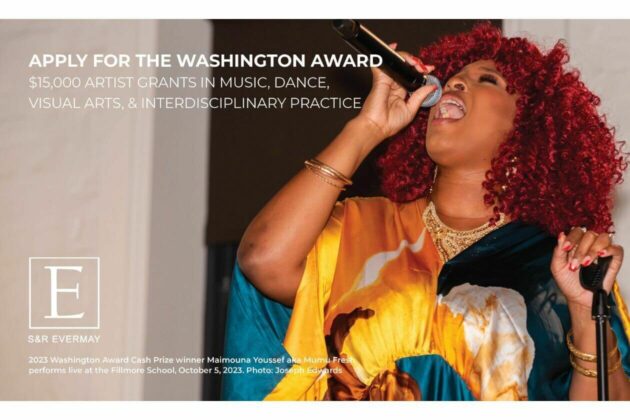

We are excited to announce that the 2024 Washington Award application opened today!

The 2024 Washington Award offers four cash prize awards of $15,000 for individual artists working in the field of music, dance, visual arts, and interdisciplinary practice (one award per category). This award, one of the largest grants in D.C. available to individual artists, provides unrestricted cash support to artists at critical moments in their careers to freely develop and pursue their creative ideas.

Since its inception in 2001, the Washington Award has recognized artists in music, dance, interdisciplinary practice, and visual arts. In a renewed commitment to supporting the artistic community of Washington DC, the Washington Award is eligible to DC artists who prioritize social impact in their practice.

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

DC Labor History Walking Tour

Come explore DC’s rich labor history with the Metro DC Democratic Socialists of America and the Labor Heritage Foundation. The free DC Labor History Walking Tour tour will visit several landmarks and pay tribute to the past and ongoing struggle

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy