Photo by PoPville flickr user D©Bloom

Griffin & Murphy, LLP, is a boutique law firm in Washington, D.C. concentrating its practice in real estate law (including development, finance, leasing, zoning and condominium conversions), as well as estate planning and probate, civil litigation, and business law. The attorneys of Griffin & Murphy, LLP are licensed to practice law in the District of Columbia, Maryland and Virginia. Griffin and Murphy, LLP was founded in 1981.

Please send any legal questions relating to real estate, rentals, buildings, renovations or other legal items to princeofpetworth (at) gmail (dot) com, each week one question will be featured. You can find previous questions featured here.

QUESTION:

We have a nuisance home that is right next door to our home. The owner bought this home at a city tax auction and has let it sit vacant for over 10 years and has not renovated it or even attempted to fix problems that are affecting the connecting homes. The owner has been charged the vacant tax rate by the city for the home, but that doesn’t seem to affect him at all. This house sits in between my house and the house on the corner. We have both tried to contact the owner to see what he plans to do with the home or at least find out when he will address his house’s problems that are affecting our homes. We have received no response from him. We tried to get the city involved, but if he pays the taxes the city doesn’t care. Other than suing the owner, which I am sure will cost time and money on my part, do we have any other recourse? (Note: The property’s address has been removed from the question by PoP.)

ANSWER:

Not all problems have easy or speedy solutions, especially if you have to rely solely on governmental authorities to use scarce resources to come to your rescue. Nevertheless, you have taken the right approach by first contacting the property owner and then going to the city when you received no response. If you were informed by someone in the DC government that they cannot do anything as long as the property owner continues to pay his taxes, then I would call back and try to speak to someone else because that is incorrect. This property appears on the vacant property list maintained by DCRA, so they are aware of the property. I would contact them to let them know that you believe this property is insanitary, outline the specific problems you and your neighbors are experiencing, and copy your councilmember on any correspondence. Your local ANC may also be able to help you.

We checked the tax records and this property was formerly taxed at the Class 3 rate because it is vacant. Unfortunately, because the Class 3 rate will only apply to “blighted” properties in Tax Year 2010, it may be even more difficult to get this owner motivated to clean up the property if it is not deemed to be blighted and is taxed at a lower rate going forward. Continues after the jump.

In order for a property to be considered blighted, either DCRA or the Board of Condemnation of Insanitary Buildings must make a determination that the vacant property is unsafe, insanitary or otherwise threatens the public health, safety or general welfare of the community. In reaching this conclusion, those two governmental bodies are allowed to consider the following factors: (i) failure to keep the building openings weather-tight and secured against the entry of birds, vermin and trespassers; (ii) failure to keep the exterior walls free of holes, breaks, graffiti and loose or rotting materials; (iii) failure to keep all balconies, porches, awnings, stairways and appurtenant structures in safe and sound condition; or (iv) the structure is boarded up. This property is currently boarded up, which will help your case. When you contact DCRA, let them know that the house is boarded up and any other circumstances that would persuade them to consider this a blighted property.

Additionally, you might be able to sue your neighbor for creating a private nuisance (a common law tort) if your neighbor’s failure to maintain the house is interfering with your use and enjoyment of your property. However, your neighbor will only be liable if the interference is intentional and unreasonable, which means that there is a certain amount of nuisance that will be considered reasonable. Successful private nuisance cases typically involve the occurrence of extreme noise, light, odor, pest infestation or vibration.

On the bright side, we looked at the tax records for this property and it appears that the owner owes over $33,000.00 in property taxes, so you may have the chance to buy the house in the near future at a tax sale auction or someone else may buy this house and fix it up.

This response was prepared by Mark G. Griffin and Patrick D. Blake of Griffin & Murphy, LLP. The material contained in this response has been prepared for informational purposes only and should not be relied upon as legal advice or as a substitute for a consultation with a qualified attorney. Nothing in this response should be considered as either creating an attorney-client relationship between the reader and Griffin & Murphy, LLP or as rendering of legal advice for any specific matter.

Recent Stories

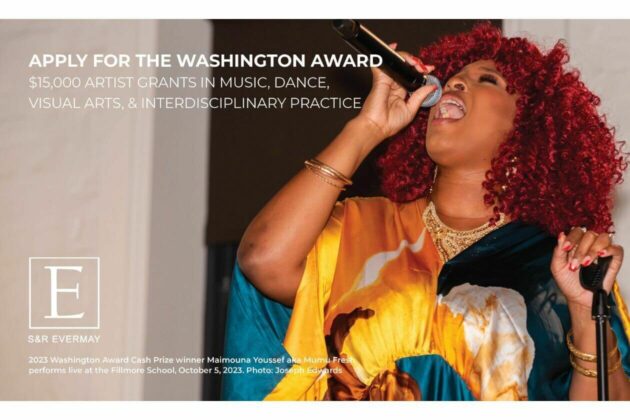

We are excited to announce that the 2024 Washington Award application opened today!

The 2024 Washington Award offers four cash prize awards of $15,000 for individual artists working in the field of music, dance, visual arts, and interdisciplinary practice (one award per category). This award, one of the largest grants in D.C. available to individual artists, provides unrestricted cash support to artists at critical moments in their careers to freely develop and pursue their creative ideas.

Since its inception in 2001, the Washington Award has recognized artists in music, dance, interdisciplinary practice, and visual arts. In a renewed commitment to supporting the artistic community of Washington DC, the Washington Award is eligible to DC artists who prioritize social impact in their practice.

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

DC Labor History Walking Tour

Come explore DC’s rich labor history with the Metro DC Democratic Socialists of America and the Labor Heritage Foundation. The free DC Labor History Walking Tour tour will visit several landmarks and pay tribute to the past and ongoing struggle

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy