List Price at Contract: $308,900.

List Date: 7/24/2009

Days on Market: 5

Settled Sales Price: $380,000.

Settlement Date: 09/22/2009

Seller Subsidy: $0.

Bank Owned?: Yes

Type Of Financing: Conventional with $38,000. (10%) down payment.

Original GDoN Post is: Here.

Recent Listing is: Here.

This was an interesting Good Deal or Not (GDoN) post as there was a reader who went ahead and put an offer in. Although it needed some work, this foreclosed Victorian rowhome was listed at $308,900. and garnered multiple offers. It ultimately sold over $70,000. above the list price.

Although located literally just a block east across North Capitol, homes on the northeast side of Eckington can still usually be had at lower price points than their very similar Victorian counterparts on the Bloomingdale side. Check out the neighborhood blog which includes some great history. Eckington landmarks include the refurbished McKinley Technical High School, which is a focal point that sits high up on a hill. I often meet NE Eckington residents during my frequent visits to the largest unofficial dog park in DC (also affectionately referred to as Fedex Field, since it is next door to the main Fedex building). In addition to Fedex, XM/Sirius Radio is an Eckington-based business. North Capitol Main Streets, Inc. is a notable tenant, as well. Bloomingdale and Eckington residents (myself included) can be found at the public pool on Lincoln Road during the summer months.

PoP noted that the closest dining option seemed to be the Big Bear Café, located at 1st and R St NW. It’s worth mentioning that Eckington is just north of NOMA and the New York Avenue Metro. There is a new Marriott Courtyard at the Metro, as well as a Five Guys and other food options. Given the push from NOMA Bid, as well as North Capitol Main Streets, I expect great things to continue in this area.

Recent Stories

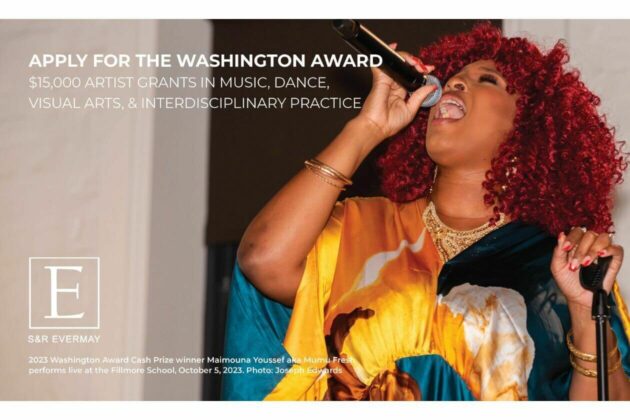

We are excited to announce that the 2024 Washington Award application opened today!

The 2024 Washington Award offers four cash prize awards of $15,000 for individual artists working in the field of music, dance, visual arts, and interdisciplinary practice (one award per category). This award, one of the largest grants in D.C. available to individual artists, provides unrestricted cash support to artists at critical moments in their careers to freely develop and pursue their creative ideas.

Since its inception in 2001, the Washington Award has recognized artists in music, dance, interdisciplinary practice, and visual arts. In a renewed commitment to supporting the artistic community of Washington DC, the Washington Award is eligible to DC artists who prioritize social impact in their practice.

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

DC Labor History Walking Tour

Come explore DC’s rich labor history with the Metro DC Democratic Socialists of America and the Labor Heritage Foundation. The free DC Labor History Walking Tour tour will visit several landmarks and pay tribute to the past and ongoing struggle

Frank’s Favorites

Come celebrate and bid farewell to Frank Albinder in his final concert as Music Director of the Washington Men’s Camerata featuring a special program of his most cherished pieces for men’s chorus with works by Ron Jeffers, Peter Schickele, Amy