DSCN3714, originally uploaded by Prince of Petworth.

“Dear PoP,

In the midst of the budget cuts and tax raises, one tax is quietly being decreased: the one that levies a 10% tax on owners of vacant property. In my opinion, it has actually been very effective in getting longtime slumlords to sell or fix vacant and dilapidated property. While it’s impossible to prove such causation, I think we’ve seen enough benefits to continue supporting the heightened rate, particularly when it’s bringing in millions of dollars to the coffers are a time when our city needs it most. So why are they looking to raise just about every tax conceivable, yet let slumlords off the hook?”

What do you guys think – is it a mistake to lower the tax on vacant property?

Recent Stories

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

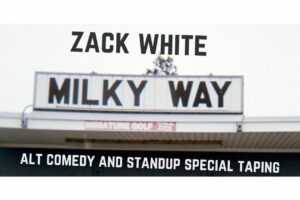

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two

Bethesda Fine Arts Festival

The 2024 Bethesda Fine Arts Festival will be held May 11 & 12, 2024 and will feature fine art created by 120 of the nation’s best artists, live entertainment and Bethesda restaurants.

Located in Bethesda’s Woodmont Triangle, along Norfolk, Auburn