In real life, hipchickindc is licensed as a real estate broker in the District of Columbia and Virginia, and as a real estate salesperson in Maryland. Unless specifically noted, neither she nor the company that she is affiliated with represented any of the parties or were directly involved in the transaction reported below. Unless otherwise noted, the source of information is Metropolitan Regional Information Systems (MRIS), which is the local multiple listing system. Information is deemed reliable but not guaranteed.

Featured Property: 1300 Kenyon St NW Unit 2

Original List Price: $529,000.

List Price at Contract: $529,000.

List Date: 04/24/2009

Days on Market: 15

Settled Sales Price: $529,000.

Settlement Date: 05/22/2009

Seller Subsidy: $5000.

Bank Owned?: No.

Type Of Financing: FHA

Listing History: Purchased from the builder new in 2004 for $420,000.

Original GDoN Post is: Here.

Recent Listing is: Here. Click the main pic to see the rest of the unit.

Note that this is the second Good Deal or Not Revisited (GDoN-R) to have been active on the market for a very short period of time. This property sold at asking price with a $5000. credit toward the buyer’s closing costs. Real estate in DC is moving at a nice healthy clip as lots of buyers are taking advantage of sub-5% fixed rate mortgages and the $8000. Federal Tax Credit for first timers.

Built by Bogdan Builders, the four units in this condo originally sold in 2004. I love that the previous listing indicates the date and time that offers were due in by. For anybody that missed the insanity of the DC real estate market in 2004, people really were falling over each other to make offers on condos and they were rushing to make those deadlines. The purchase price for the brand new unit was $420,000., but remember that at that moment in time, Target was a mere giant hole in the ground. The buyer paid cash.

One thing that we see on this transaction that never would have happened in downtown DC for a new condo in 2004, is that the buyer used FHA financing. FHA allows the buyer to make a 3.5% down payment, rather than the 15% minimum now required for many conventional loan products for condos. Since none of the condos built in the early to mid-2000s needed to get FHA approval for the entire building, the lender uses a process called a spot approval to make sure the building meets certain criteria, such as a limited percentage of units owned by investors and appropriate reserve funds in place.

Recent Stories

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

There’s a reason Well-Paid Maids has hundreds of positive reviews from happy clients.

The home cleaning company pays cleaners — who are W-2 employees — a living wage starting at $24 an hour. Plus, cleaners are offered benefits, including insurance, 24 paid days off a year, 100% employer-paid commuting costs and more.

Lexi Grant, an operations manager at Well-Paid Maids, said it best: “People deserve their work to be respected and recognized. When that happens, you love what you do, and you create the best results.”

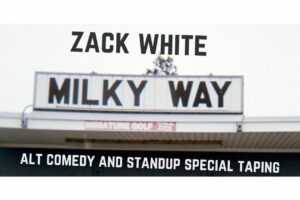

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two

Bethesda Fine Arts Festival

The 2024 Bethesda Fine Arts Festival will be held May 11 & 12, 2024 and will feature fine art created by 120 of the nation’s best artists, live entertainment and Bethesda restaurants.

Located in Bethesda’s Woodmont Triangle, along Norfolk, Auburn