DSCN5569, originally uploaded by Prince of Petworth.

Tony from the Neighborhood Development Company sent the following info:

“The Residences at Georgia Avenue (4100 Georgia Avenue, NW) is a seven-story building which consists of 6 stories of affordable apartments, ground floor retail, and 54 at grade and below grade parking spaces. The 7-story building contains 72 apartment units with large windows and open floor plans and uses a state of the art ‘spacesaver’ parking elevator from Germany that allows residents to consolidate two parking spaces one over another.

The residential development is comprised of 36 two-bedroom units and 36 one-bedroom apartments averaging approximately 830 and 650 square feet respectively. Recreational green space is provided on the roof. The apartment portion of the development and the retailer will have their own separate entrances off Georgia Avenue. The property’s ground floor has been purchased by Yes! Organic Market who is currently designing a 10,000 square foot grocery store at this location. The project is now leasing apartments.

Due to the property falling in the affordable housing bracket there are income minimums and maximums. For the one bedroom the rent is $1009.00 per month with a minimum income of $34,600 and a maximum income of $41,340. For the two bedrooms the rent is $1202.00 per month with a minimum income of $41,200 and a maximum income of $47,220 for 2 persons, $53,160 for three persons, and $59,040 for four persons.”

I’ve always been curious about what the affordable housing rates were. Does it seem it reasonable?

Recent Stories

Photo by Aimee Custis Ed. Note: If this was you, please email [email protected] so I can put you in touch with OP. “Dear PoPville, Mission on Saturday night (04/13) in…

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Looking for something campy, ridiculous and totally fun!? Then pitch your tents and grab your pokers and come to DC’s ONLY Drag Brunch Bingo hosted by Tara Hoot at Whitlow’s! Tickets are only $10 and you can add bottomless drinks and tasty entrees. This month we’re featuring performances by the amazing Venus Valhalla and Mari Con Carne!

Get your tickets and come celebrate the fact that the rapture didn’t happen during the eclipse, darlings! We can’t wait to see you on Sunday, April 21 at 12:30!

Cinco de Mayo Weekend @ Bryant Street Market

SAVE THE DATE for Northeast DC’s favorite Cinco de Mayo celebration at Bryant Street NE and Bryant Street Market!

Cinco de Mayo Weekend Line up:

Friday, May 3:

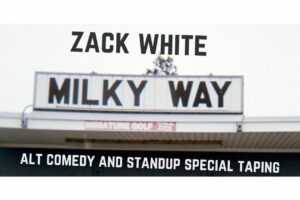

Alt Comedy Show – Zack White – Milky Way

DC’s most annoying comedian is moving to Brooklyn- come say good riddance April 20th at Slash Run with a special half hour show and taping. Featuring standup, powerpoint presentations, and dumb prop stuff, Milky Way is a send-off to two