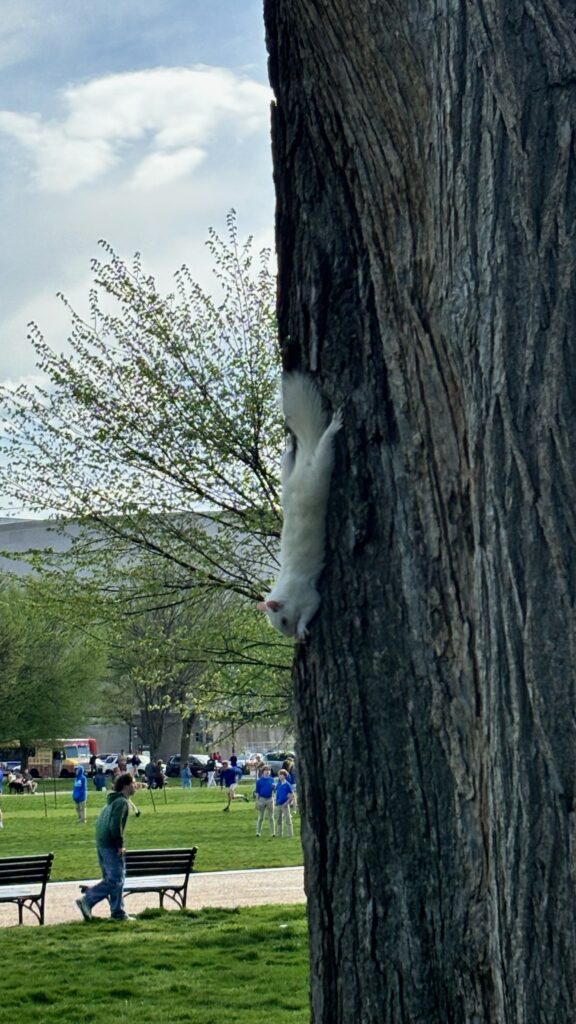

DSCN6104, originally uploaded by Prince of Petworth.

Yesterday the Post’s DC Wire reported:

“One of the most vocal proponents of the DC vote bill offered an alternative today: stripping DC residents of the obligation to pay federal taxes.

Rep Louie Gohmert (R-Texas) told a hearing of the House Subcommittee on the Constitution, Civil Rights and Civil Liberties that he was introducing a bill this week to exempt District residents from paying taxes.”

Today DCist had a great list of alternative options to DC’s non vote problem.

But I’m gonna make the FQOTD a simple one – would you rather have a vote in Congress or not have to pay Federal taxes? I’m hesitant to admit but if given the choice, I’d have a very tough time turning down an exemption to Federal taxes. You?

Recent Stories

For many remote workers, a messy home is distracting.

You’re getting pulled into meetings, and your unread emails keep ticking up. But you can’t focus because pet hair tumbleweeds keep floating across the floor, your desk has a fine layer of dust and you keep your video off in meetings so no one sees the chaos behind you.

It’s no secret a dirty home is distracting and even adds stress to your life. And who has the energy to clean after work? That’s why it’s smart to enlist the help of professionals, like Well-Paid Maids.

Unlock Peace of Mind for Your Family! Join our FREE Estate Planning Webinar for Parents.

🗓️ Date: April 25, 2024

🕗 Time: 8:00 p.m.

Metropolitan Beer Trail Passport

The Metropolitan Beer Trail free passport links 11 of Washington, DC’s most popular local craft breweries and bars. Starting on April 27 – December 31, 2024, Metropolitan Beer Trail passport holders will earn 100 points when checking in at the

DC Day of Archaeology Festival

The annual DC Day of Archaeology Festival gathers archaeologists from Washington, DC, Maryland, and Virginia together to talk about our local history and heritage. Talk to archaeologists in person and learn more about archaeological science and the past of our